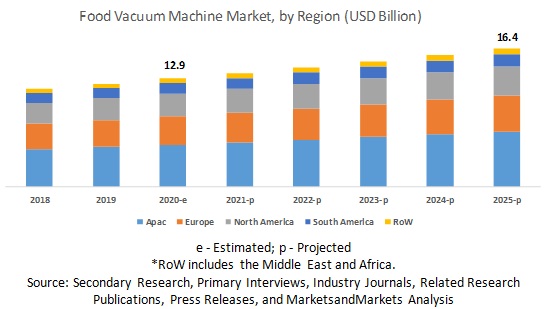

The report “Food Vacuum Machine Market by Machinery Type (External Vacuum Sealers, Chamber Vacuum Machines, Tray Sealing Machines, Other Machinery Types), End-use Sector (Industrial, Commercial, Domestic), Process, Application, Packaging Type, and Region – Global Forecast to 2025″, The food vacuum machine market is projected to grow from USD 12.9 billion in 2020 to USD 16.4 billion by 2025, recording a compound annual growth rate (CAGR) of 5.0% during the forecast period. The major factors driving the growth of the food vacuum machine market include the focus on hygienic packaging solutions, the need to preserve food and minimize food wastage, and the increasing demand for ready-to-eat and convenience food.

Report Objectives:

- Determining and projecting the size of the food vacuum machine market, with respect to machinery type, packaging type, process, application, end-use sector, and regional markets, over five years, ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the market

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=30013862

Based on process, the skin segment is projected to hold the largest market share during the forecast period.

The growing demand for skin vacuum packaging for premium food options and its greater acceptance because of the introduction of new films that can accommodate different shapes of food is projected to drive the overall growth of the market.

Based on application, the meat & seafood segment is projected to hold the largest market share during the forecast period.

The demand for food vacuum machines for application in the meat industry is projected to witness significant growth in the coming years. This is attributed to the growing consumption of meat, resulting in the increasing demand among consumers to preserve it through vacuum sealing.

The Asia Pacific region is projected to be the largest and fastest-growing market for food vacuum machines during the forecast period.

The Asia Pacific region is projected to be the largest and fastest-growing market for food vacuum machines during the forecast period. The region witnesses a high demand for convenience and packaged food products, which require food vacuum machines to seal the food content for further preservation. Also, the rapidly growing income of the middle-class population in the region will encourage increased expenditures on packaged food. The advent of COVID-19 has resulted in consumer preference for hygienically packaged food. These factors are projected to create growth opportunities for food vacuum machine manufacturers in countries such as India, China, Japan, and Australia.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=30013862

Key players in the global food vacuum machine market include Ulma Packaging (Spain), Proseal (UK), Multivac (Germany), Electrolux Professional (Sweden), Henkelman (Netherlands), Henkovac International (Netherlands), and Promarks (US). These players have broad industry coverage and high operational and financial strength.

Recent Developments:

- In November 2019, Ulma Packaging (Spain) invested nearly 5 million euros to complete its expansion of a tray sealing plant in Onati, Spain, after its recent expansion. This new plant will help the company to increase its production capacity.

- In September 2019, Multivac (Germany) launched new tray sealing and chamber belt machines for automated vacuum packaging of food products in film pouches. This will help the company to boost its product portfolio.

- In January 2019, Proseal (UK) launched a new seal testing system to enable fruit growers and processors to identify the ideal seal strength for packaging applications for fruits & vegetables.