What This Report

Will Provide?

This study involved four major

activities in estimating the current size of the healthcare analytical testing

services market. Exhaustive secondary research was carried out to collect

information on the market, its peer markets, and its parent market.

The next step was to validate these findings, assumptions, and sizing with

industry experts across the value chain through primary research. Both top-down

and bottom-up approaches were employed to estimate the complete market size.

After that, market breakdown and data triangulation procedures were used to

estimate the size of segments and subsegments.

Expected Revenue Growth:

[327 Pages Report] The global healthcare

analytical testing services market size is projected to reach USD 8.4

billion by 2025 from USD 4.9 billion in 2020, at a CAGR of 11.4%.

Major Growth Boosters:

In the current global

scenario-where the focus on biologics and biosimilars has risen-it is expected

that the benefits of advanced healthcare analytical testing services will

ensure their greater adoption. The increasing demand for specialized testing

services, the number of clinical trials, and the acceptance of the QbD approach

in pharmaceutical research and manufacturing are other factors driving the

growth of this market.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=108923833

Recent Developments:

In January 2020, LabCorp’s Drug Development Business launched Preclinical,

Clinical, and Post-Approval Cell, and Gene Therapy Development Solutions

In June 2019, Eurofins Scientific acquired Transplant Genomics Inc. (US) to

expand its transplantation testing footprint

In May 2019, SGS acquired Chemical Solutions Ltd. (CSL) (US), a testing

laboratory specializing in elemental and heavy metal testing for food,

nutraceuticals, pharma, and cosmetic products

Key Questions Addressed in The Report:

1. Who are the top 10 players operating in the global healthcare analytical

testing services market?

2. What are the drivers, restraints, opportunities, and challenges in the healthcare

analytical testing services Industry?

3. What are the opportunities for stakeholders and provide details of the

competitive landscape for key players?

4. What will be growth of healthcare analytical testing services in North

America, Europe, Asia Pacific, Latin America, and the Middle East and Africa?

Pharmaceuticals and Biotechnology Industries:

Based on the end user, the

market is broadly classified into pharmaceutical & biopharmaceutical

companies, medical device companies, and contract research organizations

(CROs). Pharmaceutical & biopharmaceutical companies hold the largest share

in the market. The largest share of this segment in the market can be

attributed to the tremendous amount of analytical testing required to support a

product from discovery, development, and clinical trials, through manufacturing

and marketing.

Request Sample Report:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=108923833

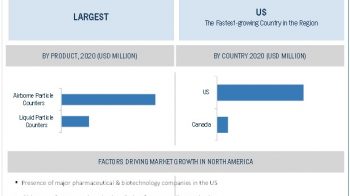

Regional Growth Analysis:

North America held the largest

share in the healthcare analytical testing services market in 2019. This

dominance of North America in this market is due to the presence of many

pharmaceutical and biopharmaceutical companies, high investments and rising

focus on the biosimilars & biologics segment, and high allocation to

R&D.

Key Players:

The prominent players in the

global healthcare analytical testing services market are Eurofins Scientific

(Luxembourg), LabCorp (US), SGS (Switzerland), Charles River Laboratories (US),

WuXi PharmaTech (China), PPD (US), Element Materials Technology (UK), Pace

Analytical (US), Intertek (UK), Merck KGAA (Germany), Source BioScience (UK),

Almac Group (Ireland), ICON (Ireland), Frontage Labs (US), STERIS PLC (US), PRA

Health Sciences (US), Syneos Health (US), Medpace Holdings (US), LGC Limited

(UK), and Anacura (Belgium).