The global hydrogen fueling station market is projected to reach USD 1,129 million by 2030 from an estimated USD 380 million in 2023, at a CAGR of 16.8% during the forecast period. The key factor such as growing demand for the zero-emission vehicles and strong government support have led to many top OEMs investing in the research and development of fuel cell electric vehicles (FCEVs). Due to increasing demand for the FCEVs, there is a need for the hydrogen fueling station infrastructure. Furthermore, growing public and private investments in emerging economies have accelerated the growth of hydrogen fueling station market.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=205206436

The on-site, by supply type, is expected to grow at the highest CAGR during the forecast period.

Based on supply type, the hydrogen fueling station market has been split into on-site and off-site. The on-site segment is expected to be the fastest growing market during the forecast period. Governments of various countries are taking initiatives to shift toward clean and green fuels, which is possible through the onsite production of hydrogen through electrolysis. The growth of on-site segment is attributed by the to rising investments in green hydrogen projects and inclination toward zero-carbon fuel to power fuel cell vehicles.

Based on solution, components is expected to be the largest segment during the forecast period

This report segments the hydrogen fueling station market based on components into two segments: engineering, procurement and construction (EPC), and components. The components segment is expected to be the largest segment during the forecast period. Components is a crucial element of the hydrogen fueling station infrastructure. Easy and cost-efficient hydrogen storage and supply via compression is likely to support the growth of the components segment.

Asia Pacific is expected to be the largest region in the hydrogen fueling station market

Asia Pacific is expected to be the largest hydrogen fueling station market during the forecast period. Several countries in the Asia Pacific are planning pilot projects or carrying out full-scale development of electrolyzer based hydrogen fueling station in the region. This has increased investments toward pilot projects, feasibility studies, and new deployments of hydrogen fueling stations in the Asia Pacific, especially in South Korea and Japan. These factors are expected to fuel the growth of the hydrogen fueling station market in the region. Furthermore, rapid adoption of hydrogen powered light duty and heavy duty vehicles across these countries have accelerated the growth of hydrogen fueling station market.

Ask Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=205206436

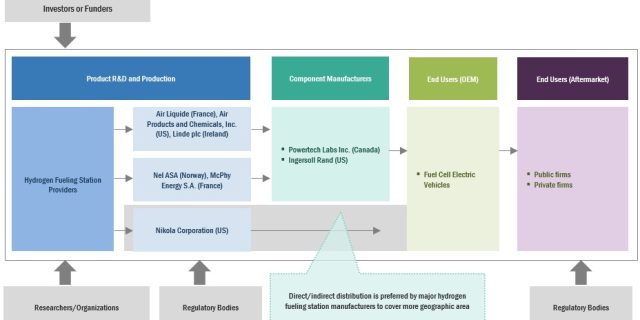

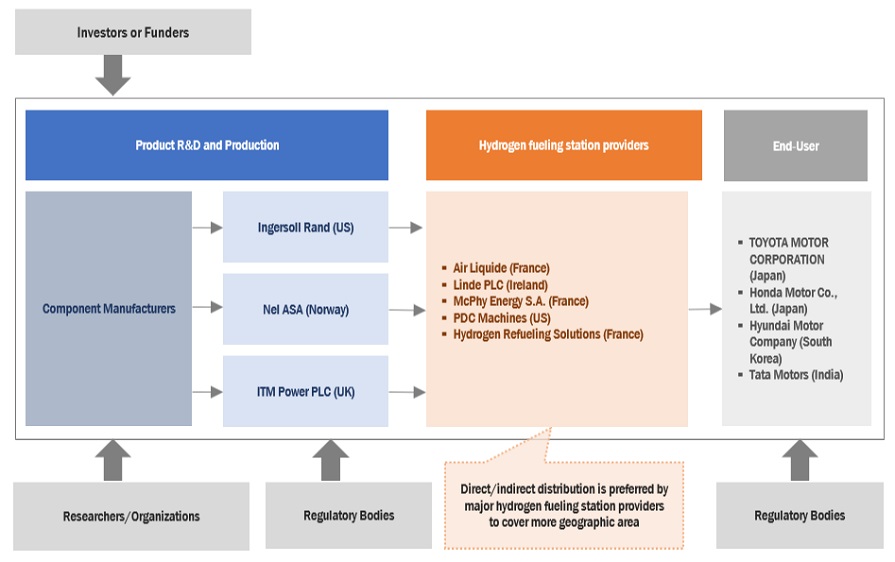

Key Market Player

Some of the major players in the hydrogen fueling station market are Air Liquide (France), Air Products and Chemicals, Inc. (US), Linde plc (Ireland), Nel ASA (Norway), and McPhy Energy S.A. (France). The major strategies adopted by these players include acquisitions, contracts, product launches, agreements, joint ventures, partnerships, investments and expansions.

Recent Developments

- In February 2023, Air Liquide will join TotalEnergies to create an equally owned joint venture to develop a network of hydrogen stations. This initiative will help facilitate access to hydrogen, enabling the development of its use for goods transportation and further strengthening the hydrogen sector.

- In October 2022, Air Products and Chemicals, Inc., Schenk Tanktransport, and TNO collaborated together on the Clean Hydrogen and Road Transport Project (CH2aRT) project to develop hydrogen trucks and a public hydrogen refueling station.

- In October 2022, Linde plc received a contract from Fountain Fuel for the delivery of three hydrogen refueling stations in the Netherlands. Linde will supply three of its Twin IC90 hydrogen refueling systems.

- In December 2022, Nel ASA signed an agreement via its subsidiary Nel Hydrogen Inc. with an US-based energy company for the supply of 16 hydrogen fueling stations.

- In April 2019, McPhy Energy S.A. launched the smart “Augmented McFilling” hydrogen fueling station, especially for fueling heavy-duty vehicles.

Browse Related Reports:

Fuel Cell Market by Type (PEMFC, SOFC, PAFC, MFC, DMFC, AFC), Application (Portable, Stationary, Vehicles (FCV)), Size (Small & Large), End User (Residential, C&l, Transportation, Data Center, Military & Defense, Utility), Region – Global Forecast to 2027

Hydrogen Generation Market by Technology (SMR, POX, Coal Gasification, Electrolysis), Application (Refinery, Ammonia Production, Methanol Production, Transportation, Power Generation), Source (Blue, Green, Gray), Generation Mode, Region – Forecast to 2027

Hydrogen Energy Storage Market by State (Gas, Liquid, Solid), Technology (Compression, Liquefaction, Material Based), Application (Stationary Power, Transportation), End User (Electric Utilities, Industrial, Commercial), Region – Global Forecast to 2027