The automotive industry has witnessed a shift in technology from the use of mechanical systems to electrical systems. With the advancement of mechatronics, linear as well as rotational motions in vehicles can be achieved using electrical prime movers. As electric content in cars has increased steadily in the last two decades, vehicle electronics have become a key product differentiator for automakers in recent years. In developing countries, the adoption of advanced safety features in vehicles is driven by regulatory bodies and consumer interest. The increasing adoption of advanced safety features, in turn, increases the number of electronic devices in the vehicle. Hence, the number of wiring harnesses that connect electrical devices has been increasing year-on-year. The addition of cameras and other safety-related sensors, along with multiple terminals needed for battery packs used in electrified powertrains, is driving the growth of the automotive terminal market. Automotive terminal manufacturers utilize a good portion of their engineering resources to develop new products or improve existing terminals for the automotive industry, which itself is focused on improving fuel mileage and reducing the use of lead (RoHS), cost, and vehicle weight.

The Global Automotive Terminal Market is projected to grow at a CAGR of 10.03% from 2017 to 2025, to reach USD 27.14 billion by 2025.

Opportunities:

- Energy-efficient E-Mobility

- Future perspective of connected, autonomous, and semi-autonomous vehicles

The global automotive industry has witnessed a transformation during the last decade with digital communication technologies making rapid inroads in vehicles. Connected, autonomous, and semi-autonomous vehicles are more like a future package of new automotive technology. These breakthrough technologies are transforming the traditional structure of the automotive industry by bringing in a new business model and changing the nature of the automotive industry. As automakers are developing a variety of modern technologies that will make vehicles far more digitally connected than they are now, vehicles in the future will be very different from the ones vehicle drivers are familiar with. Microprocessors, microcontrollers, sensors, communication modules, and battery electronics are digitally connected with each other with the help of hardware and software. These connected and autonomous vehicles require a huge amount of electrical connections and terminations of hardware to battery electronics. These technologically advanced vehicles will have long wiring harness systems and a good amount of harness components like connectors and terminals. With the huge amount of reliability of connected software and hardware inside a vehicle, a continuous supply of power will be needed from the battery packs. Automotive terminals play a vital role in the continuous supply of power for hardware and software inside a vehicle. Advancements in termination technology would create new revenue pockets for automotive terminal manufacturers. This is expected to boost the automotive terminal market in the future.

Request FREE Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=136249480

The ecosystem of the automotive terminal market includes global automotive terminal manufacturers such as TE Connectivity (Switzerland), Delphi (UK), Furukawa Electric (Japan), and PKC Group (Finland). These original equipment manufacturers (OEMs) account for more than 80% share of the global automotive terminal market. These OEMs have long-term supply contracts with global automakers such as General Motors (US), Daimler (Germany), FCA (UK), BMW (Germany), and Tata Motors (India). It is therefore difficult for the new entrants and local manufacturers of terminals to compete in the automotive terminal market. TE Connectivity offers more than 1000 varieties of terminals that are used in vehicles more than any other competitor.

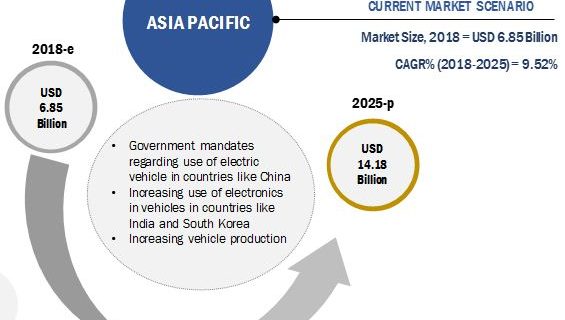

The above 100 A segment of the automotive terminal market, by current rating, is expected to grow at the highest CAGR during the forecast period. It is followed by the 41–100 A and below 40 A segment. However, below 40 A segment is estimated to account for the largest share in the automotive terminal market, following its wide applications in electronics content in a vehicle. The Asia Pacific region is estimated to account for the largest market share in the below 40 A segment. Below 40 A terminals are used in passenger vehicles for mirror control, speedometer, headlamps, etc.

The battery system segment is estimated to be the fastest-growing market for automotive terminals, by the application. It is followed by the lighting system, infotainment, body control & interiors, safety & security system, cooling, and engine & emission control. The battery system segment is estimated to experience stable growth due to the increasing electronics applications that depend on power generated from battery packs in a vehicle.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136249480

The passenger car segment is estimated to be the fastest-growing market for automotive terminals followed by light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) segments.

The Asia Pacific region is estimated to be the largest automotive terminal market for the passenger car segment. The North American region is the fastest-growing market for automotive terminals owing to the increase in sales of electronically advanced sport utility vehicles (SUVs) and luxury vehicles.

Target Audience:

- Automotive terminal manufacturers

- Infrastructure development companies

- Automobile organizations/associations

- Compliance regulatory authorities

- Government agencies

- Information Technology (IT) companies & system integrators

- Investors and Venture Capitalists (VCs)

- Raw material suppliers for automotive terminal

- Traders, distributors, and suppliers of automotive terminal