Indian Peptide Drugs Market

The Indian peptide drugs market is expected to reach USD 883.0 Million in 2022 from USD 381.8 Million in 2016 and is expected to register a CAGR of 15.0%. Factors such as increasing prevalence of chronic diseases, rising aging population, and increasing healthcare expenditure are contributing to the growth of this market.

Indian Peptide Drugs Market Dynamics

Drivers

- Rising Incidence of Diseases

- Favorable Government Initiatives for the Pharmaceutical Sector

Restraint

- Availability of Alternative Drugs

Opportunity

- Patent Expiry of Blockbuster Peptides

Challenge

- Regulatory and Pricing Issues

The Indian peptide drugs market is segmented by type and application.

By type, the Indian peptide drugs market is segmented into hormonal, antifungal, antibiotic, ACE inhibitor and others. Hormonal segment dominated the Indian peptide drugs market in 2016. The growing incidence of diabetes, cancer diseases in India are the key factors driving the growth of this segment.

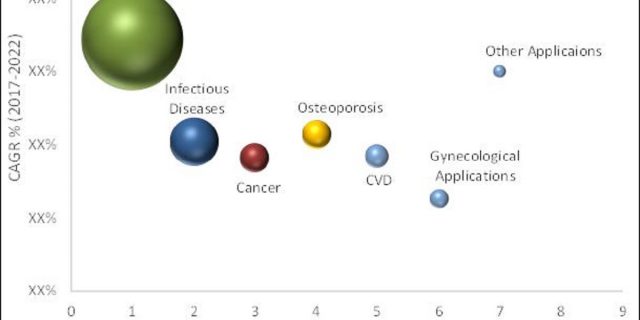

On the basis of application, the Indian peptide drugs market segmented into diabetes, cancer, cardiovascular disease (CVD), gynecological application, infectious diseases, osteoporosis, and other applications (acromegaly, multiple sclerosis, and hepatitis).

Download a PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=77044734

Key players in the Indian peptide drugs market

Key players operating in the Indian peptide drugs market include Abbott Laboratories (U.S.), Sanofi S.A. (France), Eli Lilly and Company (U.S.), Cipla Limited (India), and Biocon Limited (India), Intas Pharmaceuticals Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), Cadila Pharmaceuticals (India), Lupin Limited (India), Emcure Pharmaceuticals Ltd. (India), Novartis International AG (Switzerland), Dr. Reddy’s Laboratories Limited (India), and Alkem Laboratories Limited (India)

Indian Heparin Market

The Indian anticoagulant drugs market is expected to reach USD 170.2 Million by 2022 from USD 127.8 Million in 2016, at a CAGR of 4.9%. The growing incidence of coagulation disorders and government support for pharmaceutical companies are expected to drive the growth of this market.

Indian Heparin Market Dynamics

Drivers

- Growing Incidence of Coagulation Disorders

- Government Support for the Pharmaceutical Industry

Restraint

- High Degree of Consolidation to Hinder Small Players from Entering the Market

Challenge

- Regulatory and Pricing Issues

The Indian anticoagulant drugs market is segmented by type.

By low molecular weight heparin type, the Indian anticoagulant drugs market is segmented into heparin sodium, enoxaparin sodium, fondaparinux, and dalteparin sodium. The enoxaparin sodium segment dominated the Indian anticoagulant drugs market in 2016. The growing incidence of coagulation disorder in India are the key factors driving the growth of this segment.

Request a Sample Pages @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=77044734

Key players in the Indian anticoagulant drugs market

Key players operating in the Indian anticoagulant drugs market include Sanofi (France), Emcure Pharmaceutical Pvt. Ltd. (India), Cipla Ltd. (India), Bharat Serum (India), Pfizer Inc. (US), Abbott Laboratories (US), and Lupin Ltd. (India), Dr. Reddy’s Laboratories (India), Intas Pharmaceuticals Ltd. (India), Samarth Life Sciences (India), Claris Lifesciences Limited (India), Gland Pharma Limited (India), Mylan Pharmaceutical (India), Torrent Pharmaceuticals (India), and Micro Labs Ltd. (India).