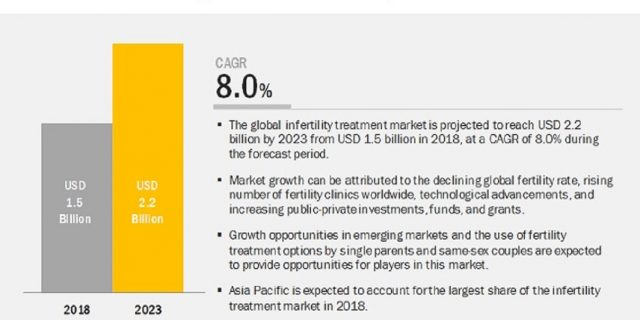

The infertility treatment market is expected to grow from USD 1.5 billion in 2018 to USD 2.2 billion by 2023, at a compound annual growth rate (CAGR) of 8.0% during the forecast period.

Market Dynamics

Growth in the infertility treatment market is primarily driven by factors such as the declining global fertility rate; rising number of fertility clinics worldwide; technological advancements; and increasing public-private investments, funds, and grants. Growth opportunities in emerging markets and the use of fertility treatment options by single parents and same-sex couples are also expected to provide opportunities for players in this market. On the other hand, the high procedural cost of assisted reproductive techniques in developed markets and unsupportive government regulations for certain infertility treatment options are expected to limit market growth to a certain extent.

Download a PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43497112

Driver: Declining fertility rate

Infertility is the inability of an individual to achieve clinical pregnancy. Fertility rates measure the average number of children per woman. The fertility rate worldwide is declining steadily owing to various factors such as the growing trend of late marriages and increasing age-related infertility. Global fertility rates are projected to decline to 2.4 children per woman by 2030 and 2.2 children per woman by 2050. This declining fertility rate has led to a significant increase in the demand for infertility treatment devices that determine the fertility window in males and females.

Restraint: High procedural cost of assisted reproductive techniques in developed markets

Along with fertility surgeries, thousands of cycles of ART procedures such as in vitro fertilization (IVF) are performed every year globally. The cost of IVF treatment varies from country to country due to lack of reimbursement policies. The average cost of one IVF cycle is USD 12,000 excluding the cost of medications; if the couple goes through three cycles, the out-of-pocket expense adds up to USD 33,000. On the other hand, the average cost of one IVF cycle in developing countries such as India ranges from USD 814.74 to USD 1,086.32, including all medications. Thus, the high cost of assisted reproductive techniques coupled with lack of insurance coverage in developed countries is restraining the growth of Infertility Treatment Devices Market.

North America is expected to hold a significant share in the infertility treatment market during the forecast period

Factors such as decreasing fertility rates, growing median age of first-time pregnancy, increase in healthcare expenditure, and presence of major players in this region (such as The Cooper Companies, Inc., Cook Group Incorporated, and Hamilton Throne Ltd.) are driving the growth of the infertility treatment market in North America.

Request a Sample Pages @

Key Market Players

The Cooper Companies Inc. (US), Cook Group Incorporated (US), Vitrolife AB (Sweden), Thermo Fisher Scientific, Inc. (US), Esco Micro Pte. Ltd. (Singapore), Genea Limited (Australia), IVFtech ApS (Denmark), Irvine Scientific (US), The Baker Company, Inc. (US), Kitazato (Japan), Rocket Medical Plc (UK), IHMedical A/S (Denmark), Hamilton Throne Ltd. (US), MedGyn Products, Inc. (US), ZEISS Group (Germany), and SoMATEX Medical Technologies GmbH (Germany), among others.

Recent Developments:

- In March 2018, Vitrolife AB (Sweden) received approval for the sale of its time-lapse incubator EmbryoScope+ in the US. Through this the company expanded its product sale and market visibility in the US infertility treatment market.

- In March 2018, Genea Limited (Australia) expanded its market presence in Melbourne by establishing a new fertility clinic in Melbourne

- In April 2018, Baker Ruskinn (UK) entered into a partnership with I&L Biosystems UK Ltd. (UK) as its UK sales partner with the aim to expand its sales and distribution and strengthen its presence in the UK market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst