Market Overview:

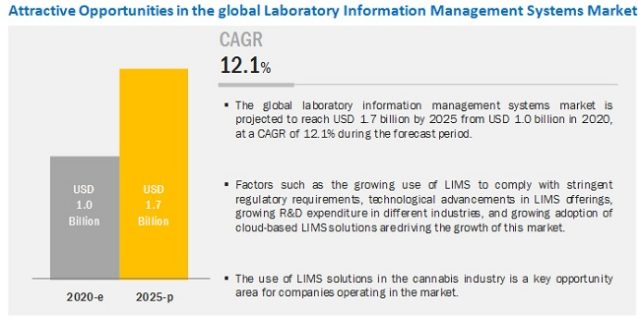

The global Laboratory Information Management Systems market is projected to reach USD 1.7 billion by 2025 from USD 1.0 billion in 2020, at a CAGR of 12.1%. Growth in this market is driven by the increasing focus on improving the efficiency of laboratories, increasing use of LIMS to comply with stringent regulatory requirements, technological advancements in LIMS offerings, increasing R&D expenditure in pharmaceutical and biotechnology companies, and the growing adoption of cloud-based LIMS.

Leading Market Players:

In 2019, LabWare (US), LabVantage Solutions (US), and Thermo Fisher Scientific (US) were the leading players in the global LIMS market. The other major players operating in this market include Abbott Informatics (US), LabLynx (US), Autoscribe Informatics (US), Agilent Technologies (US), Computing Solutions (US), GenoLogics (Canada), LABWORKS (US), Dassault Systèmes (France), Siemens (Germany), Accelerated Technology Laboratories (US), ApolloLIMS (US), Ovation (US), Novatek International (Canada), CloudLIMS (US), Eusoft (Italy), Horizon LIMS (US), and Promium (US).

- LabWare (US) is one of the prominent players in the LIMS market. The leading position of the company can be attributed to its strong brand recognition and extensive product portfolio. The company provides scalable, end-to-end solutions to various industries, such as pharmaceutical, environmental testing, contract service, forensic, chemical/petrochemical process, public health, clinical research, food, and biobanking industries. The company focuses on launching technologically advanced products and upgrading its existing ones with the help of inputs from clients. LabWare designs products according to the functional needs of end users and offers industry-specific template solutions that serve as prepackaged initiation points for project implementation.

- LabVantage Solutions (US), an innovation-centric company, constantly invests in developing and enhancing its products to understand and better serve its customers. The company focuses on organic growth strategies such as product launches and upgrades to develop its product portfolio as well as to strengthen its position in the market. In this regard, in February 2019, the company released a new version of LabVantage 8.4, a configurable, web-based LIMS solution. The company also strives to strengthen its market position by entering into partnerships. In this regard, the company extended its partnership with Lonza (Switzerland) to offer purpose-built environmental monitoring capabilities integrated with LIMS. This combined solution will provide the life sciences industry with a unified microbiology and analytical solution. Such partnerships and innovative product launches help the company to enhance its product portfolio and strengthen its distribution network.

- Thermo Fisher Scientific (US) is one of the top players in the global LIMS market. In order to maintain its leading position, the company focuses on research and development activities. In the year 2019, the company invested USD 1 billion in research and development activities. The company has a major focus on organic as well as inorganic growth strategies such as expansions and acquisitions. For instance, in March 2016, the company acquired Core Informatics (Netherlands) to enhance its informatics solutions and cloud platform.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=250610373

Recent Developments

- In February 2020, LabVantage announced the addition of a fully integrated scientific data management system to its LIMS Platform.

- In March 2020, Cloud LIMS launched COVID-19 LIMS, a free LIMS solution for COVID-19 research and testing laboratories and biobanks.

- In April 2020, Horizon LIMS partnered with SampleServer (US).

North America to dominate the laboratory information management systems market

In 2019, North America held the largest share of the market, followed by Europe. The large share of this geographical segment is attributed to the strong economies in the US and Canada, which have allowed for significant investments in new technologies, growth in biobanks, easy availability of LIMS products and services, and stringent regulatory requirements across industries.