New Revenue Pockets:

The global marine engines market is projected to reach USD 15.2 billion by 2029, showing a growth from the estimated USD 13.1 billion in 2024, with a compound annual growth rate (CAGR) of 3.0% from 2024 to 2029. Traditionally, after-sales services like maintenance and repairs have been a part of the marine engines market. However, companies are finding ways to optimize this segment to generate recurring revenue.

Advanced sensor technology allows for real-time engine performance monitoring. Engine manufacturers can leverage this data to offer remote diagnostics and predictive maintenance services. This proactive approach minimizes downtime for ship operators and ensures optimal engine health throughout its lifecycle. Subscription-based services for remote monitoring and diagnostics can be a lucrative revenue stream. Spare parts are a crucial aspect of after-sales service. Manufacturers can create user-friendly digital parts catalogs that allow ship operators to easily identify and order necessary parts online. This streamlines the procurement process and improves efficiency for both parties. Technological advancements are leading to the development of sophisticated engine control and optimization systems. These systems go beyond basic engine control to optimize fuel consumption, reduce emissions, and improve overall engine performance.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=261640121

Manufacturers can offer these systems as add-ons to existing engines or integrated into new models. This presents an opportunity to capture additional revenue and cater to the growing demand for efficient and sustainable marine transportation. As environmental regulations tighten and the focus on sustainability intensifies, the demand for cleaner-burning marine engines is rising. Manufacturers can develop conversion kits that allow existing engines to operate on cleaner alternative fuels like LNG or biofuels. This caters to ship operators who want to upgrade their existing fleets to comply with regulations or reduce their environmental impact. Engines capable of seamlessly switching between conventional fuels and cleaner alternatives like LNG offer operational flexibility for ship owners. Developing and offering such engines opens a new revenue stream while addressing the evolving needs of the shipping industry.

By capitalizing on these emerging revenue pockets, marine engine manufacturers can ensure diversified income streams and navigate the dynamic landscape of the maritime transportation sector.

Heavy Fuel Oil (HFO) continues to hold the third-largest market share in the marine engines market. HFO remains the most economical fuel option for marine engines. Its lower price point compared to cleaner alternatives like Liquefied Natural Gas (LNG) translates into significant cost savings for ship operators, especially for large vessels undertaking long voyages. This economic advantage is particularly crucial for bulk carriers and tankers transporting commodities over vast distances. Existing Infrastructure: A well-established global network of refineries and bunkering facilities readily supplies HFO at major ports worldwide. This extensive infrastructure makes it readily available for refueling ships, unlike LNG which requires specialized bunkering facilities that are still under development in many regions. This widespread availability minimizes logistical challenges and ensures smooth operations for ship operators. Installed Engine Base: The global marine fleet consists of a vast number of existing vessels equipped with engines specifically designed to burn HFO. Retrofitting these engines to operate on cleaner fuels can be a complex and expensive undertaking. Therefore, for many ship owners, continuing with HFO remains a viable option until the end of these engines’ lifespans.

Make an Inquiry – https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=261640121

General cargo ships hold the third-largest market share in the marine engines market due to a unique combination of factors influencing their engine requirements. General cargo ships, unlike tankers or container ships designed for specific cargo types, carry a wide variety of goods in containers, break bulk, or project cargo. This versatility translates to a need for engines that offer a balance between power, efficiency, and operational flexibility. General cargo ships typically operate on regional or interregional routes, often with frequent port calls. Compared to massive container ships that prioritize long-distance speed, general cargo vessels don’t require the most powerful engines. However, they still need sufficient power for efficient maneuvering in harbors and navigating diverse weather conditions across their routes.

Market Growth and Fleet Size: The general cargo shipping segment represents a significant portion of the global maritime transportation industry. This translates to a large and continuously growing fleet of general cargo ships, creating a steady demand for new engines. Additionally, the replacement market for existing engines in this segment further contributes to the substantial market share. Engine manufacturers cater to this market by offering a range of medium-power, fuel-efficient engines with adaptability for future clean fuel options.

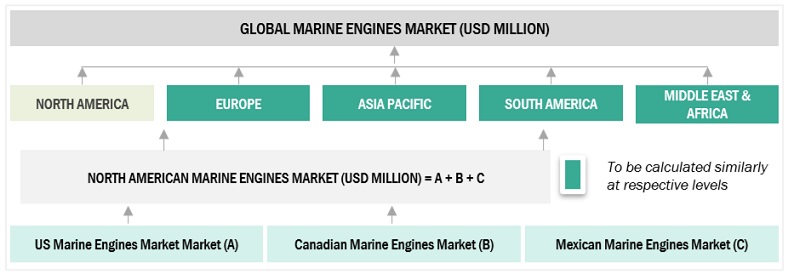

Global Marine Engines Market Size: Bottom-Up Approach

The 1,001-5,000 horsepower (hp) segment reigns supreme as the second-largest market share holder in the marine engines market for a confluence of reasons. This power range caters to a broad spectrum of vessels, encompassing large fishing vessels, offshore service vessels, ferries, and passenger ships. Optimal Balance of Power and Efficiency: Compared to the immense powerhouses required for giant container ships or tankers, the 1,001-5,000 hp range offers a sweet spot between power output and fuel consumption. This is crucial for vessels that undertake frequent stops and maneuvers, or operate on shorter routes where fuel efficiency becomes a significant operational cost factor. The sheer number of vessels within this power range category contributes significantly to its market share. These include a vast array of fishing vessels, a growing number of offshore service ships supporting the wind energy industry, and numerous ferries and coastal cargo ships operating worldwide. The ongoing need for new engines in these segments, coupled with engine replacements in existing vessels, fuels the market’s growth. The 1,001-5,000 hp segment thrives due to its versatility across various vessel types, the optimal balance it offers between power and fuel efficiency, a large and growing fleet requiring these engines, and advancements in cleaner technologies that cater to both environmental concerns and operational needs.

Ask Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=261640121

North America occupies the fourth position in the global marine engines market share, despite boasting a well-developed maritime industry. Compared to some regions heavily reliant on maritime trade, North America has a well-established network of inland waterways for freight transportation. This translates to a larger focus on barges and tugboats, which typically require smaller, less powerful engines compared to ocean-going vessels. A significant portion of the North American maritime fleet, particularly in sectors like dry bulk cargo, consists of older vessels. While offering opportunities for engine replacement within the existing market, these vessels often utilize older, less powerful engines, impacting the overall market share for high-horsepower engines typically used in newer ships. North America enforces some of the strictest environmental regulations for marine emissions. This can create uncertainty for ship operators hesitant to invest in new, compliant engines due to potential future changes in regulations or fuel options. This hesitancy can dampen the demand for new, high-power engines. North America’s fourth position in the marine engines market share stems from a combination of factors, including its established inland waterway system, an aging fleet dynamic, stringent environmental regulations, and the rise of Asian shipyards. However, opportunities exist for future growth through fleet modernization, infrastructure development for cleaner fuels, and continued innovation within niche segments.