Global Marine Engines Market Overview

The marine engines market is expected to grow from an estimated USD 11.7 billion in 2022 to USD 13.3 billion by 2027, at a CAGR of 2.6% during the forecast period. The growth in international marine freight transport, aging fleet, and adoption of smart engines for performance and safety are the main drivers for the marine engines market. The rise of e-commerce and online trade, and rising demand for dual-fuel and hybrid engines are expected to offer lucrative opportunities for the marine engines market during the forecast period.

A few major players that have a wide regional presence dominate the marine engines market. The leading players in the marine engines market include Caterpillar (US), Volkswagen Group (MAN Energy Solutions (Germany), Volvo Penta (Sweden), Hyundai Heavy Industries Co., Ltd. (Japan), and Rolls-Royce Holdings (UK). Major strategies adopted by these players include sales contracts, product launches, contracts, partnerships, agreements, and acquisitions to increase their market shares and expand their geographic presence. Sales contracts and agreements were the most commonly adopted strategies from January 2019 to February 2022.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=261640121

By Power Range, the above 20,000 HP segment is expected to be the largest segment during 2022-2027.

The above 20,000 HP segment accounted for a larger market share in 2021. The above 20,000 HP marine engines mostly have applications for very large vessels, which include large bulk carriers, cargo vessels, containerships, defense vessels, LPG carriers, LNG carriers, and others. They are primarily used as prime moves to facilitate the movement of these ships through the waters. The growth of global maritime trade and the requirement of more and more vessels to cope with tight vessel supply, as well as the requirement to replace some of the existing fleet to comply with the stringent International Maritime Organization (IMO) regulations put in force from January 2020, are expected to drive the growth of the above 20,000 HP segment during the forecast period.

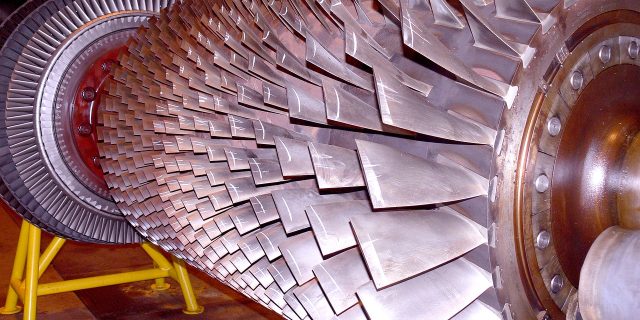

By Type, the two stroke segment is expected to hold the largest market share during the forecast period.

The two stroke segment held a larger share of the marine engines market in 2021. The two-stroke engines can run on low-grade fuels, have better efficiency and high power; and are more reliable. They are preferred as main engines in vessels in case of long journeys via oceans when higher power and efficiency are required. They offer high torque at a low engine speed, which helps boats/vessels cruise at a constant speed without adjusting the engine speed. Two-stroke engines have one revolution of the crankshaft during one power stroke. They also have a larger ratio in terms of power to weight and are slow-speed, crosshead engines. The growth of international maritime trade will lead to an increase in the requirement of prime movers for ocean going vessels, which eventually will drive the demand for two stroke marine engines during the forecast period.

Request Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=261640121

Recent Developments

- In February 2022, MAN Energy Solutions signed a cooperation agreement with Hyundai. Under this agreement, Hyundai will provide OPL solution to shipowners seeking EEXI compliance for their fleet without disrupting their business operations, and it will contribute to net-zero emission goals of maritime industry.

- In February 2022, Volvo Penta signed an agreement with Danfoss’ Editron division. Through this agreement, both the companies aim to work together to boost electrification in the marine sector.

- In December 2021, Caterpillar Marine signed a contract to provide power solutions for Edda Wind’s series of four new Commissioning Service Operation Vessels (CSOVs) and two new Service Operation Vessels (SOVs), which will be delivered between 2022 and 2024.

- In November 2021, Hyundai Heavy Industries (HHI) signed a contract to build the second of three upgraded Aegis-equipped next-generation warships of the South Korean Navy. It is also working on the construction of the first warship. HHI signed a contract worth USD 470 million with the country’s Defense Acquisition Program Administration.

- In August 2021, Rolls Royce Holdings signed an agreement to sell its Bergen Engines, medium-speed liquid fuel and gas engines business, to Langley Holdings, a global engineering group.