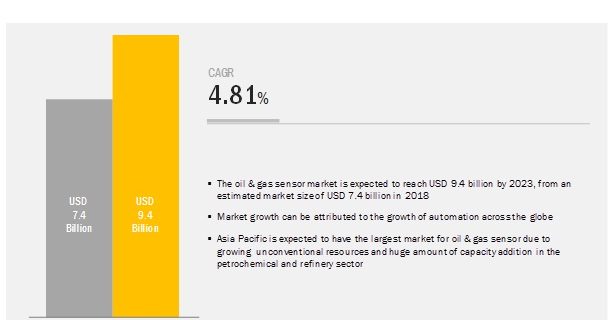

The global oil & gas sensors market is projected to reach USD 9.4 billion by 2023 from an estimated USD 7.4 billion in 2018 at a CAGR of 4.81%. The growth of the oil & gas sensors market is mainly driven by the increasing adoption of ultrasonic sensors, growing focus on IoT related products across the globe, and the increasing demand for sensors due to refining capacity addition. For instance, OECD markets are expected to notice overall gains in the refinery processing capacity with Turkey adding 200,000 b/d to SOCAR’s STAR refinery at Aliage. Thus, the overall increasing additions in refining capacity are expected to boost the demand for sensors in the oil and gas industry

Market Ecosystem:

The oil & gas sensors market is dominated by a few major players that have a wide global presence. The leading players in the oil & gas sensors market include Emerson (US), Honeywell Automation (US), ABB (Switzerland), GE (US), Siemens (Germany), and TE Connectivity (Switzerland).

Download PDF Brochure Now – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=212567893

Asia Pacific is estimated to be the fastest growing market for oil & gas sensors during the forecast period. The region has been segmented, by country, into China, Japan, India, Australia, and the Rest of Asia Pacific. The oil & gas sensors market in the region is primarily driven by the growing focus on automation in the oil & gas industry and rising investments in petrochemical and refining sector in emerging countries such as India and China. According to IEA, oil demand in Asia Pacific would grow by an average of 2% annually by 2023. Therefore, there is a need for a huge investment in the oil & gas industry in the next 3–4 years. This will, therefore, create a demand for oil & gas sensors in the region.

The oil & gas sensor market, by application, is segmented into remote monitoring, condition monitoring & maintenance, and analysis & simulation. The remote monitoring segment is estimated to be the fastest growing market during the forecast period. Remote monitoring includes pipeline integrity monitoring, tank level monitoring, equipment-based monitoring, condition based monitoring (CBM), pipeline Pressure Relief Valve monitoring, refineries Pressure Relief Valve monitoring , wellhead automation, and monitoring. Moreover, the real-time data acquisition and monitoring reduces cost by eliminating maintenance downtime or unplanned failures. Thus, remote monitoring helps in improving the process and productivity.

Wired sensor accounts for the largest market share during the forecast period

The report segments the oil & gas sensors market, by connectivity, into wired and wireless. The wireless segment is expected to grow at the highest CAGR during the forecast period. Reduction in downtime, maximum efficiency and saving maintenance cost is driving the wireless sensor market in the coming years. Need for lower cost of installation and adoption of new sensor technologies would drive the market for wireless sensors globally. This will provide promising business opportunities to the manufacturers of wireless oil & gas sensors.

Request For Sample Pages of the Report – https://www.marketsandmarkets.com/requestsampleNew.asp?id=212567893

Recent Developments:

- In May 2018, Siemens introduced a new generation temperature transmitter for various sensor types that provide results in extreme temperatures up to -5 degree Celsius. It uses 4 wire connection for both sensors SITRANS TH420 and TR420 to increase data accuracy and reliability.

- In March 2018, ABB expanded its operations network with a new collaborative operations center for the oil, gas, and chemical industries in Norway.

- In May 2017, Emerson introduced a new platform for its Rosemount X-well technology for surface sensing temperature measurement solutions.

- In May 2016, Fortive (Gems Sensors) launched a new Ultrasonic Level Sensor, XLS-1. The ultrasonic sensing technology enables the level sensor to sense oil, water, and harsh chemicals, while ignoring foam and condensation.