Disruption in Electrification – Opportunities worth ~USD 26 Bn are opening up in the E-Mobility industry, as Li-Ion battery sales are likely to touch ~$70 Bn by 2025.

According to MarketsandMarkets analysis,

- There is ~USD 26 Bn potential opportunity within E-Mobility eco-system, more than half of which is contributed by various EV components including batteries, motors, and chargers.

- E-Mobility Industry represents an opportunity worth US$ 18-26 Bn for the companies operating in the entire EV value chain.

- Fuel cell is one of the emerging segments and was one of the most talked trends in auto industry in 2021.

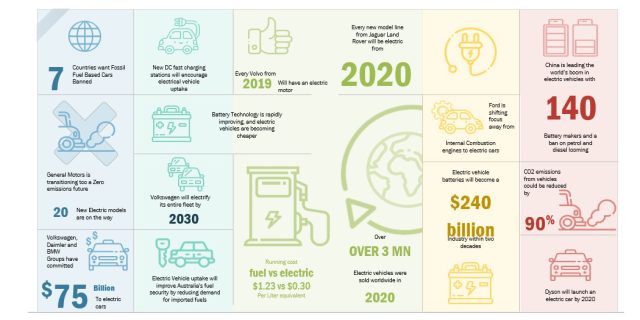

- Despite the COVID-19 pandemic, EV sales registered sprawling growth rate of over 94% in 2021 as compared to 2020.

- Considering the unaffected sales of EV in 2021, the outlook in 2022 is expected to remain positive despite third wave of the pandemic.

- Growing EV sales across all major regions is expected to create huge opportunities EV charging stations market.

- Growing electric trends would create a shift in revenue mix in coming years.

Currently, businesses have low access to primary intelligence to clarify some unknowns and adjacencies in these opportunity areas –

- Adoption levels of E-Mobility is low as compared to ICE. Currently it ranges between 5-10% globally, however, in some countries it is approaching 15% – 20%. As electric vehicle help reduces vehicle emission, it is getting push from the governments as well.

- Currently, Battery Electric Vehicles (BEVs) in the passenger car segment are largely sold for personal transportation.

- Increasing focus on electric commercial transportation drives the adoption of electric trucks and electric buses. Government investments in public transportation to offer huge opportunity for electric buses.

- Adjacent markets such as electric vehicle components, electric vehicle battery, and electric vehicle charging stations and required services to provide immense growth opportunities.

- Battery technology is changing rapidly and introduction of new battery technology such as Sodium Ion, Lithium-Air, and Solid-state batteries is expected to disrupt the EV market.

Key uncertainties/perspectives that industry leaders seek answers to:

For E-Mobility OEMs:

- What are the major buying criteria of customers? Rate and rank various purchase criteria

- Product/Service features

- Vehicle range

- Innovation

- Price

- Branding

- Gap analysis between OEM’s product offering and Customer Needs. What changes or innovations could Client focus on?

- What are the customer perceptions about vehicle electrification and connectivity, its strengths and weakness vs. those of its competitors?

- What is the Customer perception as to how OEMs can augment its service offerings?

- What is the purchasing process? Who are the key decision makers and influencers? Who are the current vendors?

For Companies in Adjacent markets:

- What are the key regulations surrounding vehicle electrification?

- Major market trends and dynamic. How is client’s current business position and strategy aligned with industry dynamics, disruptions, and opportunities?

- What are the key components that the clients are keen on?

- When EV tipping point can be achieved?

- Competitive landscape and market share rankings, assessment of client’s competitive position and product offerings vs. major competitors.

- What should be our key differentiations/Value Proposition in company’s offerings?

- How the automotive trends like ride sharing, connected vehicle, light-weighting, and autonomous vehicles set to impact the electric vehicle business?

Therefore, MarketsandMarkets research and analysis focuses on high-growth markets and emerging technologies, which will become ~80% of the revenues of auto players from the EV ecosystem in the next 5-10 years.

Download PDF Brochure: https://marketsandmarkets.com/practices/pdfdownload.asp?p=E-Mobility