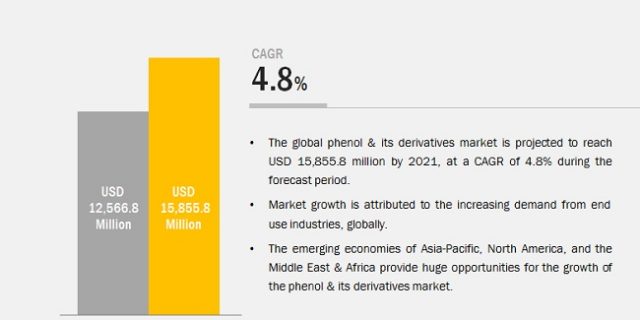

The global phenol derivatives market is projected to reach USD 19.78 billion by 2026, at a CAGR of 4.6% from 2016 to 2026. The growing demand from major end use industries such as automotive and electrical and electronics goods, and other industrial applications in emerging economies, are driving the global phenol derivatives market.

Download PDF Brochure

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=383

Expansions was the key growth strategy adopted by industry players in the global phenol derivatives market. This strategy accounted for a share of 38%, between 2011 and 2015, of all the growth strategies adopted by market players. Besides expansions, companies are venturing into agreements to expand their phenol derivatives portfolios across the world. The agreement strategy accounted for a 31% share of all the development strategies between 2011 and 2015. Companies are also focusing on the acquisitions strategy which accounted for a 19% share between 2011 and 2015. The Asia-Pacific region was the most active region from 2011 to 2015, in terms of strategic initiatives, and expansions was one of the preferred strategies.

Major manufacturers such as Compañía Española de Petróleos S.A.U. (CEPSA) (Spain), LG Chem (South Korea), Honeywell International Inc. (U.S.), INEOS (Switzerland), Mitsui Chemicals, Inc. (Japan), Royal Dutch Shell plc (Netherlands), The Dow Chemical Company (U.S.), Saudi Basic Industries Corporation (SABIC) (Saudi Arabia), Kumho Petrochemical Co., Ltd. (South Korea), and PTT Global Chemical Public Company Limited (Thailand) are profiled in this report. These companies have adopted both, organic and inorganic growth strategies.

Compañía Española de Petróleos S.A.U. (CEPSA) (Spain), LG Chem (South Korea), Honeywell International Inc. (U.S.), INEOS (Switzerland), and Mitsui Chemicals, Inc. (Japan) are among the most active players in the global phenol derivatives market.

Read More :

https://www.marketsandmarkets.com/PressReleases/phenol-derivative.asp

Compañía Española de Petróleos S.A.U. (CEPSA) (Spain) is the most active player in the phenol derivatives market. It accounted for the largest share of all the developmental activities undertaken in the phenol derivatives market. As a part of its strategy, the company focuses on expanding its phenol derivatives business by venturing into agreements, acquisition, and expansion. In December 2015, The Dow Chemical Company (U.S.) and DuPont (U.S.) announced a merger with a definitive agreement under which the companies combined in an all-stock merger of equals. The combined company was named DowDuPont. In April 2015, Cepsa (Spain) has inaugurated a new chemical plant in China. The new facility has an annual production capacity of 250,000 tons of phenol derivatives, 150,000 tons of acetone and 360,000 tons of cumene.

Another company that has established a strong foothold in the global phenol derivatives market is LG Chem (South Korea). The company is focused on expansion and agreements. LG Chem started up its new phenol derivatives/acetone plant in Daesan in February 2013. This new plant is having capacity of 300,000 tonnes/year of phenol derivatives and 180,000 tonnes/year of acetone.