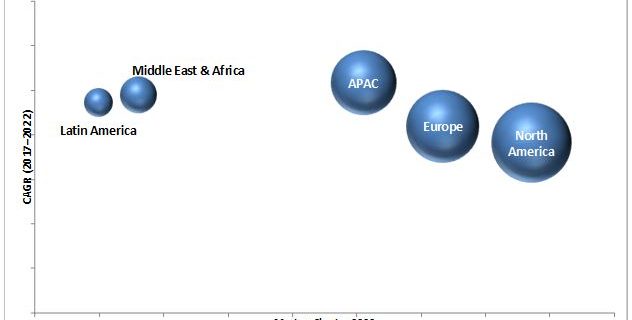

MarketsandMarkets expects the Proactive Services Market to grow from $1.63 billion in 2017 to $4.35 billion by 2022, at a Compound Annual Growth Rate (CAGR) of 21.6% during the forecast period.

The Asia-Pacific (APAC) region is expected to grow at the highest CAGR during the forecast period. The region comprises key economies, such as China, India, Japan, Singapore, Malaysia, and Australia. APAC is expected to witness the highest adoption rate of proactive services, owing to the presence of many Small and Medium-sized Enterprises (SMEs) which are inclined toward the adoption of proactive services. The increasing adoption of IT infrastructure by enterprises in the developing countries is one of the driving factors facilitating the growth rate of the Proactive Services Market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=221642525

Enterprises across various industry verticals are adopting digital technology and services to automate business processes. Proactive services vendor monitors the complex IT infrastructure to identify key issues and address them before they might disrupt the business process. The BFSI vertical is expected to be the fastest-growing vertical in terms of the adoption of proactive services during the forecast period. The BFSI vertical is a group of various organizations that are into banking services such as core banking, corporate, retail, and investment; financial services such as payment gateways, stock broking, and mutual funds; and insurance services covering both life and general insurance policies. Growing digitalization in the banking sector coupled with rising data traffic is expected to drive the demand for proactive services during the forecast period.

The device/endpoint management application type is expected to grow at a higher CAGR during the forecast period. Companies are deploying proactive services to improve network uptime, reliability, and reduction in unplanned outages. Security remains to be a critical issue that restricts its adoption; however, this issue is gradually being eradicated through rigorous security tests conducted to the highest standards by third parties.

The SMEs segment is expected to grow at a higher CAGR in the Proactive Services Market by organization type during the forecast period. Organizations with less than 1,000 employees are categorized as SMEs. The increased competition has prompted the SMEs to invest in proactive services for better quality of network performance across organizations and make informed decisions for their business growth. More than larger enterprises, SMEs face resource crunch and require methods to solve the complexities for better cost optimization on their assets and requirements. The increasing usage of complex IT infrastructure among various organizations has led to the implementation of proactive services among SMEs as well.Speak to Research Expert @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=221642525

![[Latest 2028] Cloud Security Market Estimation, Key Players, Growth Opportunities](https://mnmblog.org/wp-content/uploads/2024/04/cust-350x196.webp)