Softgel Capsules Market in terms of revenue was estimated to be worth $1.1 billion in 2023 and is poised to reach $1.5 billion by 2028, growing at a CAGR of 6.3% from 2023 to 2028 according to a new report by MarketsandMarkets™. The growth of this market is majorly driven by the benefits of softgel capsules, increasing demand for dietary supplements and nutraceuticals, and rising demand for naturally sourced ingredients.

Download an Illustrative overview: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238329912

In 2022, the gelatin segment accounted for the largest market share of the softgel capsules market based on material type.

Based on material type, the global softgel capsules market is segmented into gelatin and other materials, such as carrageenan (natural seaweed extract), plant-derived cellulose, hydroxypropyl methylcellulose (HPMC), pullulan (obtained from the fermentation of starch), and starch-glycerin. The gelatin segment accounted for the largest market share in 2022. The rising demand for health supplements and the benefits of soft gelatin capsules, such as easy to swallow, no taste, unit dose delivery, tamper-proof, and availability in a wide range of colors, shapes, and sizes, are supporting the growth of this market. In extension the growth of raw materials used for softgel capsules.

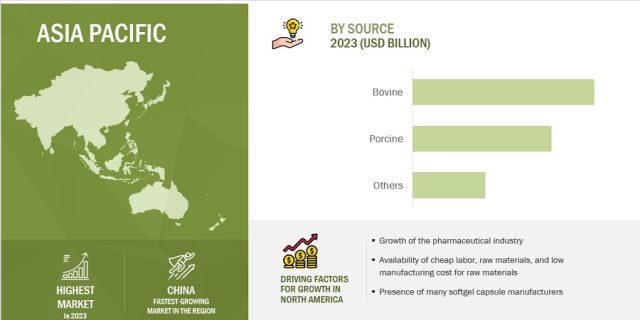

In 2022, the bovine segment accounted for the largest share of the softgel capsules market based on source.

Based on source, the global softgel capsules market has been segmented into porcine, bovine, and other sources (including poultry, marine, and plant sources). The bovine segment accounted for the largest share of the softgel capsules market in 2022. Bovine is one of the most widely used sources to manufacture gelatin because of its abundance and easy availability. They are known for their soft and flexible texture, which makes them easy to swallow and digest. The abundance and easy availability of bovine are supporting its growth in the market.

In 2022, the nutraceutical and dietary supplement industry segment accounted for the largest market share of the softgel capsules market based on application.

Based on application, the global softgel capsules market is segmented into pharmaceutical, nutraceutical and dietary supplement, and cosmetics & personal care industries. The nutraceutical and dietary supplement industry segment accounted for the largest market share in 2022. With rising health consciousness among consumers, the demand for health supplements is rising. Thus, the growing trend of adopting healthy lifestyles is a major driver for the nutraceutical and dietary supplement industry segment.

In 2022, the Asia Pacific region is the fastest-growing region of the softgel capsules market.

The softgel capsules market is broadly divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific is the fastest growing and most dynamic market in the world and is estimated to be the most attractive regional market for softgel capsule manufacturers. Countries such as China, India, and Japan are expected to witness high growth in the market for softgel capsule raw materials because of the large population in these countries. Also, due to rising health concerns, higher incomes, and better government initiatives, the pharmaceutical market in this region is projected to grow. Together, these factors fuel the growth of the softgel capsules market in the Asia Pacific region.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=238329912

Softgel Capsules Market Dynamics:

Drivers:

- Benefits of Softgel Capsules

- Rising demand for naturally sourced ingredients

Restraints:

- Negative environmental impact

Opportunities:

- Personalization and Customization

Challenge:

- Rising prices of raw materials

Key Market Players:

Key players in the softgel capsules market include, Gelita AG (Germany), PB Leiner (part of Tessenderlo Group) (Belgium), Nitta Gelatin, Inc. (Japan), Sterling Gelatin and Croda Colloids (India), Narmada Gelatines Limited (India), Italgel S.r.l. (Italy), Darling Ingredients Inc. (US), Lapi Gelatine S.p.a. (Italy), Trobas Gelatine B.V. (Netherlands), Weishardt (France), and India Gelatine & Chemicals Ltd. (India) among others.

Recent Developments:

- In March 2023, Darlings Ingredients Inc. acquired Gelnex, which is a global producer of gelatin and collagen products. This acquisition would give the company the capacity to serve the growing needs of its collagen customers while continuing to serve the growing gelatin market.Thermo fisher launched Tumoroid Culture Medium to accelerate development of novel cancer therapies.

- In November 2022, PB Leiner established a joint venture with D&D Participações Societárias. Under the terms of this joint venture, D&D Participações Societárias will acquire a minority stake in the shares of the Brazilian plant of PB Leiner (PB Brasil Industria e Comercio de Gelatinas Ltda). The combined strength of the two companies will enable a long-term sustainable offering of a premium product range of beef hide gelatin based on PB Leiner’s technology.

- In October 2022, PB Leiner extended the gelwoRx Dsolve pharmaceutical portfolio with the launch of three new products—Dsolve B, Dsolve P, and Dsolve xTRA. Dsolve P (pig skin) and Dsolve B (beef hide) are specially developed to reduce cross-linking and fast dissolution of soft capsules. Dsolve xTRA (bovine bone) promises to perform better than Dsolve, Dsolve P, and Dsolve B.

Research Insight: https://www.marketsandmarkets.com/ResearchInsight/softgel-capsules-market.asp

Content Source: https://www.marketsandmarkets.com/PressReleases/softgel-capsules.asp