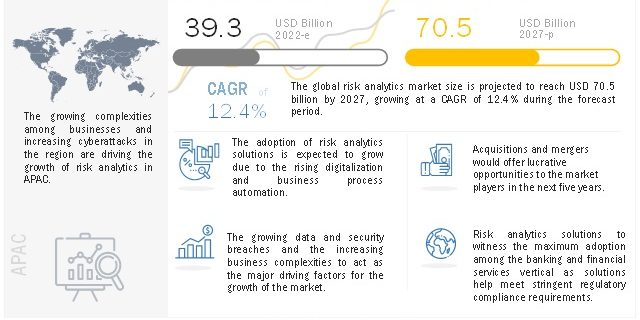

The global Risk Analytics Market size is anticipated to grow from $39.3 billion in 2022 to $70.5 billion by 2027, at a CAGR of 12.4% during the forecast period, 2022-2027.

Browse in-depth TOC on “Risk Analytics Market”

333 – Tables

47 – Figures

279 – Pages

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=210662258

The COVID-19 pandemic has made an adverse impact on credit portfolios. There has been an unprecedented rise in unemployment and disruption in economic activity, putting a strain on the solvency of customers and companies. Central banks have taken a proactive approach by injecting liquidity into the market by lowering interest rates and asset purchase programs. Managing and monitoring credit, market, liquidity, and operational risk across financial markets were hard enough with ongoing geopolitical tensions, international trade wars, and the occasional hurricanes and earthquakes. The current pandemic situation has forced chief risk officers and their teams to recalibrate old assumptions and models used to manage and monitor risk. COVID-19’s global impact has shown that interconnectedness plays an important role in international cooperation. As a result, many governments started rushing toward identifying, evaluating, and procuring reliable solutions powered by AI.

The software segment to account for largest market size during the forecast period

Based on components, the risk analytics market is segmented into software and services. The software segment has been further segmented into ETL tools, risk calculation engines, scorecard and visualization tools, dashboard analytics and risk reporting tools, and GRC software, and others (operational risk management, human resource risk management, and project risk management). The software segment is expected to hold the maximum market share in the global risk analytics market. Among all software offered in the market, GRC software has shown the highest adoption across the globe. The services segment has been divided into professional and managed services. With the rising adoption of risk analytics software is expected to boost the adoption of professional and managed services.

Strategic risk segment to to hold higher CAGR during the forecast period

Based on risk type the risk analytics market has been segmented into strategic risk, operational risk, financial risk, and others (reputational risk, environmental risk, third-party risk, and economic risk). Strategic risk segment to to hold higher CAGR during the forecast period. Strategic risks can significantly impact a company’s ability to achieve its strategies and business objectives. The financial risk segment is expected to have the largest market size of during the forecast period, due to the increasing need to analyze various growth factors that may affect the growth of the organizations.

Request Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=210662258

The SMEs segment to hold higher CAGR during the forecast period

The Risk analytics market has been segmented by organization size into large enterprises and SMEs. The market share of large enterprises is higher; however, the market for SMEs is expected to register a higher CAGR during the forecast period. To deal with challenges, such as business model sustainability, process efficiency data, reporting, and audit requirement, SMEs are increasingly adopting risk analytics solutions.

Healthcare and Life Sciences segment to hold higher CAGR during the forecast period

Based on vertical risk analytics market has been categorized into different verticals, such as banking and financial services, insurance, manufacturing, transportation and logistics, retail and consumer goods, IT and telecom, government and defense, healthcare and life sciences, energy and utilities, and other verticals The healthcare and life sciences vertical is expected to have the highest CAGR during the forecast period, as the sector is deploying risk analytics solution to streamline six sigma operations, generate quality analysis, and effectively manage complex supply chain operations. Risk analytics can help detect early signs of patient deterioration in the ICU and general ward, identify at-risk patients in their homes to prevent hospital readmissions, and prevent avoidable downtime of medical equipment leading to its adoption in the healthcare and life sciences vertical.

Speak to Research Expert @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=210662258

APAC to hold higher CAGR during the forecast period

The Risk analytics market has been segmented into five major regions: North America, Europe, APAC, Latin America, and MEA. North America is estimated to account for the highest market share in 2022, Asia Pacific is expected to provide significant growth opportunities over the next five years. The rising demand for an analytics solution, which is cloud-driven and cloud-supported, has resulted in the increasing demand for risk analytics solutions in Asia Pacific, thereby resulting in increasing investments and technological advancements across industries.

Major vendors in the global risk analytics market include IBM (US), SAP (Germany), SAS (US), Oracle (US), FIS (US), Moody’s Analytics (US), Verisk Analytics (US), Alteryx (US), AxiomSL (US), Gurucul (US), Provenir (US), BRIDGEi2i (India), Recorded Future (US), AcadiaSoft (US), Qlik (US), DataFactZ (US), CubeLogic Limited (UK), Risk Edge Solutions (India), Equarius Risk Analytics (US), Quantifi (US), Actify Data Labs (India), Amlgo Labs (India), Zesty.ai (US), Artivatic (India), Artivatic (US), RiskVille (Ireland), Quantexa (UK), Spin Analytics (UK), Kyvos Insights (US), Imply (US).

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

To find out more, visit https://www.marketsandmarkets.com/ or follow us on Twitter, LinkedIn and Facebook.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: sales@marketsandmarkets.com

Visit Our Website: https://www.marketsandmarkets.com

Content Source: https://www.marketsandmarkets.com/PressReleases/risk-analytics.asp