The shortenings market is projected to grow at a CAGR of 4.2%, in terms of value, from 2017 to reach a projected value of USD 4.57 Billion by 2022. Shortenings find a wide range of applications in the confectionery, bakery, and snacks & savory sectors. Shortenings impart multiple functionalities when used for different applications. When applied in bakery & confectionery products and snacks, shortenings provide emulsion stability, crispness, and tenderness, enhance creaming properties, and improve mouthfeel and appearance in the desired product. Shortenings offer an advantage of neutral taste, thereby enabling further addition of flavors in the products. This factors has accelerated the market growth.

The global market for shortenings is projected to reach USD 4.6 billion by 2022, at a CAGR of 4.2%

Nowadays, consumers prefer ready-to-eat and convenient food products over home-cooked food, and bakery goods serve this purpose well. The increasing number of nuclear families and working women in the developing regions, particularly in urban and semi-urban areas, and changing food consumption habits & patterns of people are driving the growth of the bakery industry, which in turn is driving the demand for bakery ingredients. Thus, a rise in the demand for baked products and growth in per capita consumption drives the shortenings market, as shortenings are a vital ingredient in baked foods.

To know about the assumptions considered for the study, download PDF brochure

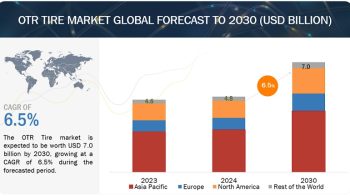

Oil segment is dominating the shortenings market owing to its increasing adoption in bakery products as it enhances the texture of the final product

Oils such as palm oil, palm kernel oil, soybean oil, canola oil, and olive oil are used in the production of shortenings. The oils are subjected to modification by various processes such as hydrogenation, fractionation, and interesterification to obtain shortenings. This are dominating the key ingredient segment as they are cost effective compare to butter. Shortenings are predominantly soybean oil-based. It has been found to be the perfect base oil and hard stock for liquid shortenings that require a beta crystal form for a stable pourable product. It is frequently found in mayonnaise, salad dressings, frozen foods, imitation dairy & meat products, and commercially baked goods.

Shortenings Market Size, By Oil, 2017-E Vs. 2022-P (USD Million)

Cargill is one of the leading manufacturers of food ingredients, agricultural products, risk management, financial, and industrial products and services around the globe. The company offers its shortenings in the fats & oils division through its food & beverage ingredients category. It offers a broad range of shortenings such as all-purpose cake, icing, and filling shortening, donut frying shortening, and tortilla shortening. The company utilizes fats & oils for its own products and also offers customized fat & oil brands to large-scale food & beverage players and retailers. Cargill operates in 67 countries through its subsidiaries and affiliates. The company continuously focuses on the development of new products to meet its customers’ specific needs. For instance, in October 2016, Cargill expanded its product portfolio of shortenings by launching high-performance bakery shortenings, which included Regal Icing Shortening NH, Regal Donut Fry Shortening, Regal Puff Pastry Shortening, Regal Cake & Icing Shortening, and Regal All-Purpose Shortening. Also, in June 2014, Cargill introduced non-GMO soybean oils to cater to the customer needs of non-GMO products. This oil would be refined in Cargill’s Des Moines, Iowa facility.

Geographical Prominence

The global shortenings market was dominated by the Asia-Pacific region, followed by Europe and North America in 2016. Shortenings are produced mainly from vegetable oils such as palm oil, soybean oil, and cottonseed oil, and fats such as butter, tallow, and lard. The Asia-Pacific countries such as China, India, Indonesia, and Japan are the major producers as well as consumers of shortening products. An increase in disposable income has led to an increase in the per capita expenditure on processed foods, such as bakery & confectionery products and snacks & savory foods. This factor has proved positive for the shortenings market growth. The rapid expansion of applications of fats & oils such as palm oil and butter has resulted in the growth of their market in the region, which has further increased the demand for fat & oil derived products such as shortenings.

The Archer Daniels Midland Company (ADM) is primarily engaged in food-processing and commodities-trading. It is one of the key players in the agricultural processing and food ingredient providing sector. The company is involved in trade, transport, storage, and processing of a wide range of grains and commodities such as corn, oilseeds, wheat, and cocoa. Its network spans across more than 140 countries. It operates globally through 272 processing plants and more than 470 crop procurement facilities, where cereal grains and oilseeds are processed into products used in the food, beverage, nutraceutical, industrial, and animal feed markets. The company operates through four segments, namely, oilseeds processing, corn processing, wild flavors and specialty ingredients, and agricultural services. The oilseed processing segment is engaged in the processing of oilseeds which include soybeans, cottonseed, sunflower seed, canola, rapeseed, and flaxseed into vegetable oils and protein meals. The salad oils manufactured are further processed to obtain products such as margarine and shortenings.

Forecasted Growth Rate Of Global Shortenings Market, By Region, 2017–2022 (USD Million)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Increase in consumption of various baked products using natural ingredients, such as breads, cakes, rolls, pastries, and alcoholic beverages, has propelled the market in the forecast period. The emerging markets such as Latin America, Africa, and Asia have potential for growth in the consumption of bakery products due to changes in lifestyles and dietary habits of consumers owing to a rise in per capita consumption. China is emerging as a potential market for bakery products. The baking industry launches new products on a continuous basis to cater to the constantly changing demand from consumers, globally.