Sports Utility Vehicle (SUV) may have varied definitions globally. However, most commonly, SUVs are defined as on-road passenger cars with off-roading features such as raised ground clearance, high ‘H’ point, and possibly a four-wheel drive. With time and with varied needs, the SUV design has changed from full-size SUVs (usually >4,600 mm length), mid-size SUVs (usually 4,000-4,600 mm length), Compact SUVs (usually 3,600-3,999 mm length), and now mini-SUVs (usually <3,600 mm length). Recently,

With comparatively smaller engines & improved fuel efficiency than full-sized SUVs and better maneuverability, compact- or sub-compact SUVs are trending in the automotive industry these days. Apart from these factors mentioned above, the segment is gaining popularity owing to its SUV-like features – higher ground clearance, high H-point, and chassis framed body structure, and preferably equipped with all-wheel drive (AWD) & terrain control features. Moreover, all this is available at a much lower price than SUVs.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=21889098

According to a recent study by MarketsandMarkets, the factors such as population, per capita income, median age, and unemployment ratio correlate with SUV sales the most. These factors showed the highest correlation coefficient with SUV demand compared with historic data of almost the last 7-8 years. Asia-Oceania has also emerged as the potential market for these vehicle segments over the next five years, with leading countries China and India. Alternatively, crossover-SUV segment has been analyzed as the leading segment in the SUV and Sub-Compact SUV segment.

Regional Trends

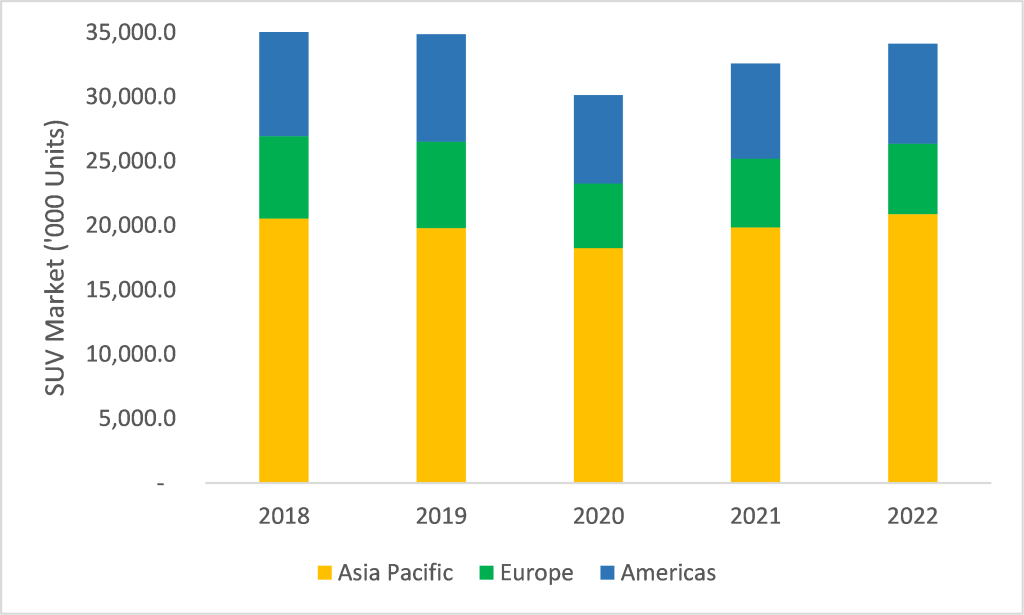

- SUV Market, by region, 2018-2022 (‘000 Units)

Source: MarketsandMarkets analysis

The global SUV market decreased by 14% in 2020 owing to Covid-19 lockdowns. However, the same revived in 2021 by 8%. In 2022, the SUV market was expected to showcase its growth by 4%-5%. The global SUV market is expected to grow at a growth rate of 4.75% from 2022 to 2027. Asia-Pacific dominates the global SUV market with ~60% of the SUVs manufactured in the region in 2020-2022. China contributed ~33-35% to the global SUV market in the same period. Americas is the second largest SUV market, contributing to ~24-25% of the global SUV market. The US is the second largest SUV market after China in terms of production, where the US contributed ~15% to the global SUV Production in 2020-2022. Japan is the third largest SUV market. However, the trend of declining overall car production in Japan is also seen in the case of SUVs. Japan’s contribution of SUVs to the global SUV market has declined from ~12% in 2018 to ~11% in 2022. Alternatively, the Indian SUV market has emerged as the most promising, with a compounded growth of ~8% from 2022 to 2027. Unlike in China, where mid-size SUVs are more popular, or US & Japan, where full-size SUVs are most popular, the Indian SUV market is dominated by the compact SUV segment. The key reason is low cost and better features, thus offering better value.

With multiple SUV launches associated with advanced features by almost all OEMs, competitive pricing of compact SUVs as compared with sedans, and other benefits offered by SUVs such as high ground clearance, robustness, and maneuverability, the Asia-Pacific is expected to continue leading the SUV market in coming years.

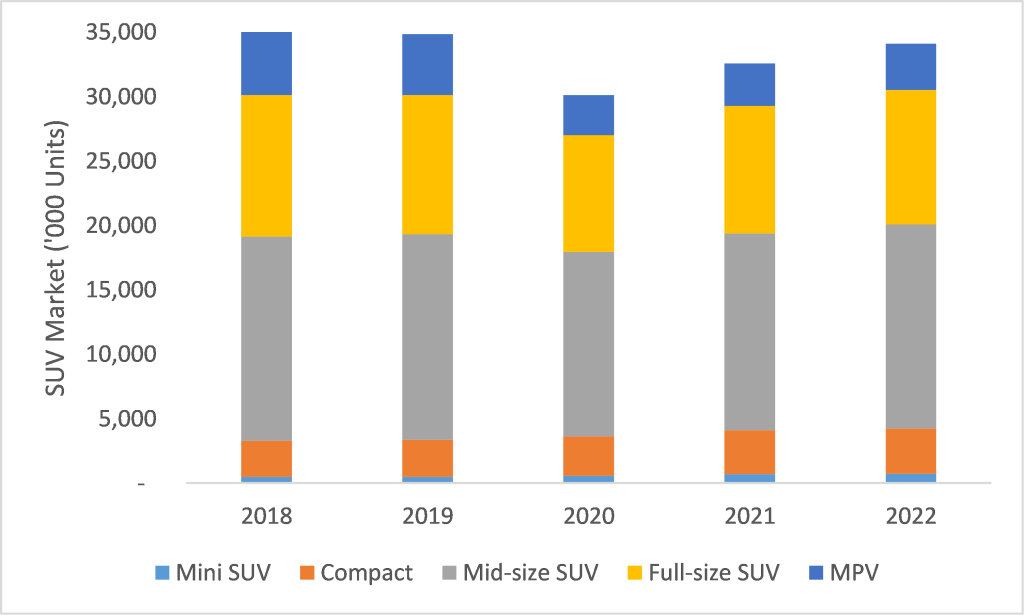

- SUV Market, by type, 2018-2022 (‘000 Units)

Source: MarketsandMarkets analysis

They are owing to the benefits of the mid-size SUVs, such as multiple engine variants like turbocharged gasoline & diesel engines and some plug-in hybrid options. Mid-Size SUVs also offer multiple transmission options (manual & automatic – CVT, DCT), 2 or 3 rows of seating options, and multiple luxuries, safety, and driver assistance features (such as smart entry, start-stop, all-wheel disc brakes, heated & ventilated seats, sunroof, ambient lighting, etc.). Finally, most importantly, mid-size SUVs offer these features at comparatively lower prices than full-size SUVs, making them the dominant SUV type. The mid-size SUVs have the largest market share in Asia-Pacific and European markets. Mid-Size SUVs dominate all key markets, including China, South Korea, Germany, the UK, Italy, Spain, Brazil, and Mexico. The only exceptions are France and India, where MPVs and compact SUVs, respectively, dominate these markets. Alternatively, the US, Canadian & Japanese markets are dominated by full-size SUVs. The trend is expected to continue in the next five years.

Request Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=21889098

Opportunities in the SUV Market

With growing concerns about green or zero-emission vehicles, even the SUV segment would have the potential to get electrified. Though electric SUVs dominate the global electric SUV market, the European market is dominated by plug-in SUVs. The European PHEV market is dominated by Volvo, Mercedes, BMW, Ford, Audi, Kia, Hyundai, and JLR. These OEMs together contribute to ~62-65% of PHEV sales in the European market in 2021-2022. The North American Market is dominated by battery-electric SUVs, where Tesla contributed >70% and the top 3 players – Tesla, Audi, and Hyundai-Kia – contributed ~81% to the North American battery-electric SUVs. The Asian region is also dominated by battery-electric SUVs, where China contributes ~75%, and Japan contributes ~10% to the Asian electric SUVs market.

- List of launched/Upcoming SUV models, 2022-2024

| MAKE/BRAND | MODEL | TYPE OF SUV | SEATING CAPACITY | ADVANCE ADAS FEATURES | LAUNCH YEAR |

| Morris Garage | MG ZS EV | Compact SUV | 5 | Yes | 2022 |

| Xpeng Motors | G9 EV | Compact SUV | 5 | Yes | 2022 |

| Mahindra & Mahindra | eKUV100 | Compact SUV | 5 | Yes | 2022 |

| Hyundai | Kona Electric 2022 | Compact SUV | 5 | Yes | 2022 |

| General Motors | Cadillac LYRIQ | Full-size SUV | 7 | Yes | 2024 |

| General Motors | Optiq | Compact Crossover | 5 | Yes | 2024 |

| Mercedes-Benz | EQA | Subcompact Crossover | 5 | Yes | 2022 |

| BMW Group | Mini Crossover EV | Crossover SUV | 5 | Yes | 2024 |

| Toyota | Lexus RZ | Mid-size Crossover | 5 | Yes | 2022 |

Source: Secondary Research, MarketsandMarkets Analysis

The electric SUV market is estimated to grow at ~30% from 2022 to 2027, where the electric SUV market will reach ~13 million units by 2027. This market would be dominated by BEVs, where the segment would contribute >60% to the global electric SUV market.

Another opportunity is for the Telematics Service Providers (TSPs) and players operating in the connected car ecosystem. Almost all SUVs are now connected whereas mid- and full-size SUVs are equipped with some of the Advanced ADAS features such as an automatic emergency braking, pedestrian detection, adaptive cruise control, night vision, driver drowsiness detection, blind spot detection, lane departure warning, hill assist etc. Apart from the premium SUV Manufacturers other OEMs like – Hyundai, MG, Tesla, Volkswagen, Mahindra&Mahindra and Tata Motors offer some advanced ADAS level 2 features in their SUVs to attract more consumers. The growing offering of these ADAS and connected features in SUVs created more opportunities for players operating in the connected car ecosystem.

Related Reports:

Electric Construction Equipment Market – Global Forecast to 2027

Electric Vehicle Market – Global Forecast 2030