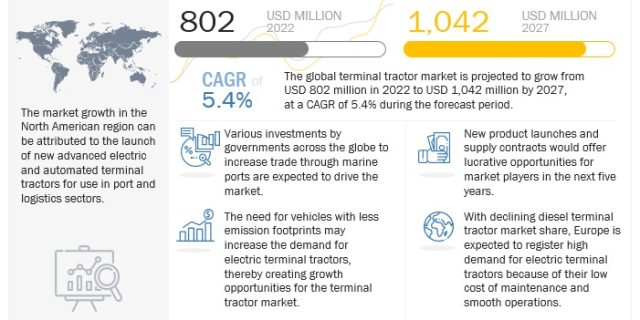

The global terminal tractor market is projected to grow from USD 802 million in 2022 to USD 1,042 million by 2027, at a CAGR of 5.4% during the forecast period.

The Warehouse & Logistics segment is expected to be the largest segment during the forecast period

Warehouse & logistics involve the storage and management of the flow of goods from point of origin to the point of consumption to meet the requirements of customers. The warehouse & logistics sector is largely dependent on global economic situations and international trade flows. The assets managed in logistics can contain physical items such as food, animals, materials, equipment, and liquids, as well as intangible items such as information, particles, and energy all these fragile items require safe and secure transportation from one point to the destination, and terminal tractors are the most important equipment in logistics terminals. The warehouse sector shows significant growth in 2022, driven by continuous activities in e-commerce, logistics, and retail chains. In May 2022, Amazon started a 4.1 million square foot industrial project in Ontario. The 5-story project will be equipped with advanced robotics operations. In August 2022, Maersk constructed a 43,000-square-meter warehouse in Duisburg, Germany. The European warehouse segment witnessed significant growth in the first half of 2022. Thus, the increased activity in the warehouse and logistics sector will offer growth opportunities for the terminal tractor market.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=153834794

Increase in trade through major marine ports to drive the market in Japan during forecast period

Japanese ports are among the key drivers of the country’s economy. The revenue generated from these ports is one of the most prominent sources for building Japans transport infrastructure and health services. Ports add significantly to the GDP and propel further industrial and technological advancements. Subsequently, the demand for related port handling equipment such as terminal tractors is expected to remain strong over the forecast period.

One of the top ports in Japan is located in the Kinki region of Osaka, close to Osaka Bay. It has economic relations with around 140 countries and has the capacity to handle more than 80 million tons of cargo yearly. In 2019, it handled 85,507,578 tons of cargo in total, comprising 49,835,000 tons of ferry products and 35,669,619 tons of container freight. The 1,350 meters long Yumeshima container terminal has three berths and handles trade with Southeast Asia, Australia, and North America. There are 6 berths available for handling international container goods in the port’s Nanko area or Sakishima section. Japan is also one of the world’s largest e-commerce markets, characterized by the dominance of Business-to-Business (B2B) transactions, increasing focus on Business-to-Consumer (B2C) sales, and emerging Consumer-to-Consumer (C2C) market. Japan’s e-commerce industry has witnessed high growth in recent years. The sudden surge in online shopping has made the industry aware of the acute shortage of warehousing facilities in the country. The gap between demand and supply due to the lack of proper warehousing facilities has created the need for setting up new fulfillment centers in Japan. Ambitious Japanese firms are investing heavily in R&D and introducing the latest and advanced technologies for material handling.

Thus, the demand for terminal tractors is predicted to grow in Japan during the forecast period. The country faces a labor shortage, which leads to higher pay and higher cost of operation during peak demand. In response to this, Japanese industries have adopted automation on a large scale to boost their manufacturing and material handling efficiencies. Thus, the demand for terminal tractors will grow in Japan.

The European region is estimated to be the second-largest market for terminal tractors in 2022

Germany is anticipated to dominate the market in the European region, followed by France, the UK, and Spain. The market growth in the region can be attributed to the robust economy of European countries and the presence of leading terminal tractor manufacturers like Kalmar (Finland), Konecranes (Finland), Terberg Special Vehicles (Netherlands), Linde Material Handling (Germany), and MAFI Transport-Systeme GmbH (Germany). These manufacturers sell container handling equipment in the global market through their dealers and distribution networks.

Key Market Players

The terminal tractor market is primarily dominated by players like Kalmar (Finland), Terberg Special Vehicles (Netherlands), Capacity Trucks (US), MAFI Transport-Systeme GmbH (Germany), and TICO Tractors (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=153834794