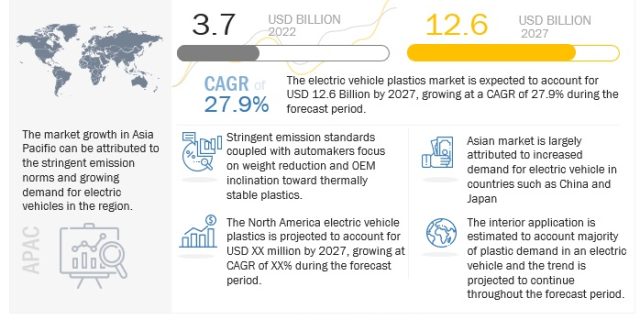

The Electric Vehicle Plastics market is projected to grow from USD 3.7 billion in 2022 to USD 12.6 billion by 2027, at a CAGR of 27.9% over the forecast period.

Race to reduce overall vehicle weight to increase driving range, reduce emissions in hybrid vehicles, and increase demand for superior quality vehicle interiors driving the plastics market in electric vehicles.

Polyurethanes and Polypropylene would hold significant market share in EV Plastics.

Car manufacturers widely use polyurethane materials for benefits in terms of comfort, safety, lightweight, and longevity with design freedom. By 2027, the polyurethane demand in the Asia Pacific is projected to be significantly higher than in Europe and North America, respectively, mainly due to increased demand for better seat comfort in vehicles. Polyurethanes are durable, lightweight, and have excellent strength, offering comfort and flexibility in design. These properties allow manufacturers to make higher-quality ergonomic seats.

Polyurethanes are ideal not only for cushioning purposes but also within the bodies of cars, where their insulation properties protect against the engines heat and noise. As polyurethanes provide equal strength as metals or conventional heavy materials and are also lightweight, their use reduces the overall vehicle weight, resulting in greater fuel efficiency and improved environmental performance. Polypropylene is considered the lightest thermoplastic because of its low density. Also, polypropylene costs are comparatively less than ABS, making it popular in cost-conscious markets such as the Asia Pacific. Hence, polypropylene would be one of EVs most preferred lightweight materials.

Request Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=219387183

Asia Pacific region to establish dominance in the global Electric Vehicle Plastics market

The Asia Pacific is expected to hold a market share of ~55% in 2022 for the electric vehicles plastics market, mainly owing to Chinas booming electric vehicles market. According to IEA, EV sales were highest in China, which tripled relative to 2020 to 3.3 million units after several years of relative stagnation. In Europe, EV sales increased by two-thirds yearly to 2.3 million units. The demand for plastic from the BEV segment in the country is anticipated to remain the most attractive throughout the forecast period owing to their popularity and zero emission characteristics compared to PHEVs. Additionally, investments from companies like Tesla in the country are further anticipated to boost the demand for electric vehicles, thus the plastic components. The government in India is pushing the deployment of EV charging stations by providing capital subsidies through Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India, (FAME) India Scheme Phase II, and state-level initiatives.

Further, the government has delicensed the activity of setting up EV charging stations to increase private sector investments and facilitate market adoption. There is a higher demand for PHEVs than BEVs in Japan, as PHEVs and HEVs are exempted from ‘automobile acquisition tax,’ i.e., registration tax and tonnage tax which has shifted the consumer preference for PHEVs as opposed to BEVs. Due to this, the demand for plastics in PHEVs is anticipated to create lucrative growth opportunities for EV plastic component manufacturers in Japan.

Thus, the Electric Vehicle Plastics Market in the Asia Pacific is driven due to increasing concerns over the carbon footprint of the automobile industry, reduction in the overall weight of vehicles to improve fuel efficiency, and government mandates to promote the adoption of electric mobility.

Interior and Powertrain would be the leading plastic applications in EVs

To achieve a longer range, an electric car must be equipped with high-capacity batteries, which adds to the cars weight. The high-capacity batteries generate heat while charging and discharging. Hence they need heat management systems. Polymer manufacturing companies are focusing on providing new polymers for next-generation battery technologies that dissipate heat effectively and quickly, thus improving battery performance. For instance, Ultramid (polyamide), a polymer offered by BASF, is used in battery casings and cell frames to reduce about 30% of vehicle weight compared to metals. Customers demand more aesthetically pleasing interiors for their vehicles. To provide this, OEMs have shifted focus to high-performance thermoplastics that provide better flowability and higher dimensional stability for easy and economical production of interior components. Plastics have proven to be the ideal material for interior components of premium cars as they are durable and aesthetically pleasing. Additionally, they help reduce NVH levels of electric vehicles.

With the increasing number of on-road EV vehicles, reaching 16.2 million units worldwide in 2021, the demand for plastic applications in battery powertrains and interior components is likely to drive the market.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=219387183

Key Players:

The Major players in Electric Vehicle Plastics market includes BASF SE(Germany), Lyondellbasell Industries Holdings B.V. (Netherlands), Sabic (Saudi Arabia), Dow (US) & Dupont (US).

Related Reports:

Automotive Wiring Harness Market – Global Forecast to 2026

Automotive Lightweight Material Market – Global Forecast to 2025

Automotive Interior Market – Global Forecast to 2027