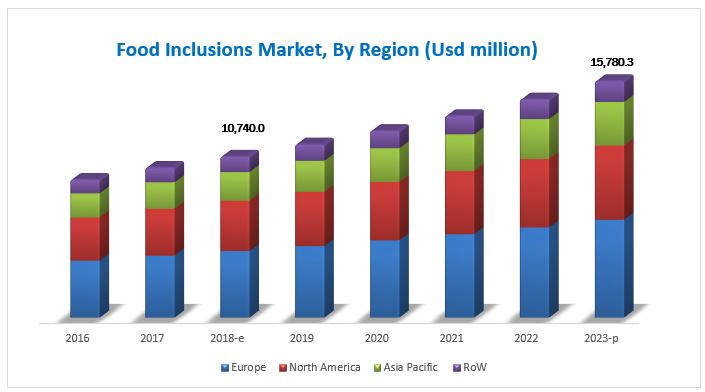

The food inclusions market is estimated at USD 10.74 billion in 2018. It is projected to reach USD 15.78billion by 2023, at a CAGR of 8.0%. The growth in the market is attributed to functional properties of food inclusions along with enhanced product appeal; clean label, non-GMO and allergen-free inclusions; and taste trends and responsive development of new flavor profiles offering new avenues for growth. The chocolate segment is projected to dominate the global market through the forecast period. The market for chocolate inclusions is largely driven by its flavor popularity and consumer inclination toward chocolate components in food products such as confectionery, ice cream, bakery, dairy, beverages, frozen desserts, and cereal products.

Objectives of the Report:

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing the segments and subsegments of the global market included in the report, with respect to individual growth trends, future prospects, and their contribution to the global market

- Identifying and profiling the key market players in the market

- Determining the market share of key players operating in the market

- Understanding the competitive landscape and identifying major growth strategies adopted by the players across the key regions

- Analyzing the market dynamics and competitive situations &

trends across regions and their impact on the prominent market players

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=43206052

The chocolate segment is projected to dominate the food inclusions market through 2023.

In 2018, the chocolate segment is estimated to account for the largest share, by type, in the food inclusions market, in terms of value. Chocolate is among the most preferred and popular flavors among consumers, worldwide, and is a major factor that is expected to drive significant consumption of chocolate inclusions in the food & beverage industry. The use of chocolate inclusions adds gloss and enhances the taste of products, while also enhancing other organoleptic properties. Thus, the use of chocolate inclusions in varieties of food applications such as confectionery, ice cream, bakery, dairy, beverages, frozen desserts, and cereal products is expected to drive the market.

The cereal products, snacks, and bars segment to dominate the food inclusions market through 2023.

Cereal products, snacks, and bars are estimated to form the major application in which food inclusions are most widely used. The consumption of various types of food inclusions in this application is largely attributed to the multiple benefits these inclusions add to the products in this category, such as addition of required flavors (fruit, chocolate, caramel, and nut), enhancement in product appearance in terms of color and visibility, and provision of required textures to products. Further, the use of inclusions enhanced the product value, both in terms of nutritional aspects as well as consumer requirements that drive the use of food inclusions in this segment.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=43206052

Asia Pacific is projected to be the fastest-growing regional market for food inclusions.

The Asia Pacific region is projected to be the fastest-growing market for food inclusions over the next five years, owing to an increase in overall economic growth, with diversity in income levels, technology, and demand from end consumers leading to enhanced scope for future growth. The main countries contributing significantly toward the growth of the market in this region are China, Japan, and Australia & New Zealand. China has always been a huge consumer base for food products, due to its large population base. The increasing purchasing power of consumers, due to the economic development in China and the influence of the Western culture on the Chinese urban middle-class, has led to an increase in demand for high- & premium-quality food products.

In this region, countries such as China and Japan are expected to account for a major share of the market. India is projected to be one of the fastest-growing markets for food inclusions in the Asia Pacific region.

This report studies the marketing and development strategies, along with the product portfolios of leading companies such Cargill (US), ADM (US), Barry Callebaut (Switzerland), Kerry (Ireland), Tate & Lyle (UK), AGRANA (Austria), Sensient Technologies (US), Puratos Group (Belgium), SensoryEffects (US), Taura Natural Ingredients (New Zealand), Georgia Nut Company (US), Inclusion Technologies (US), Nimbus Foods (UK), IBK Tropic (Spain), TruFoodMfg (US), FoodFlo International (New Zealand), and Confection by Design (UK).