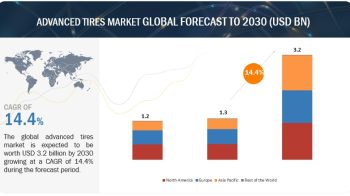

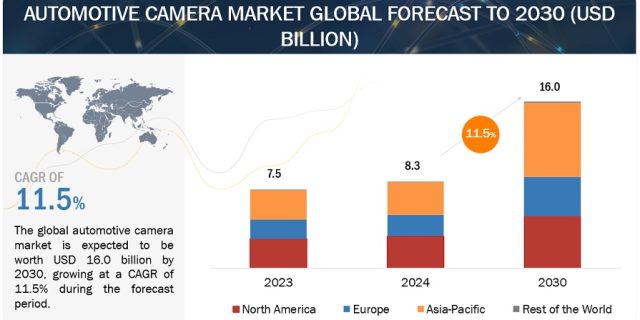

The global automotive camera market size is projected to grow from USD 8.3 Billion in 2024 to USD 16.0 Billion by 2030, at a CAGR of 11.5%. Government regulations regarding vehicle occupants and pedestrian safety is driving the growth of the automotive camera market on a global scale. Initiatives aimed at enhancing road safety, reducing traffic congestion, and supporting autonomous vehicle technology require sophisticated camera systems for accurate detection and monitoring. As regions prioritize the development of autonomous vehicles to improve urban mobility and safety, the demand for automotive cameras, including rearview, surround-view, and driver monitoring cameras, is steadily increasing.

The passenger car segment is anticipated to show the largest growth in the global automotive camera market.

The passenger car segment of the automotive camera market is expected to experience the highest growth during the forecast period. The rising demand for ADAS is a crucial factor behind the increasing use of cameras in passenger cars. ADAS technologies, such as lane departure warnings and forward collision alerts, depend on cameras to identify and react to potential dangers. Additionally, global governmental regulations are moving toward making ADAS mandatory in passenger cars. For example, the EU has expanded its requirements to include features like the Advanced Emergency Braking System (AEBS) and the Lane Departure Warning (LDW) system. These features have been mandated in EU countries from July 2022. Such regulatory measures are likely to further stimulate the market for automotive cameras in passenger cars.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=125124333

Thermal segment is anticipated to be the fastest growing technology in the global automotive camera market.

Thermal cameras in cars work by detecting heat emitted by objects, allowing them to capture images even in complete darkness. These cameras are essential for ADAS, including night vision systems and pedestrian detection. In night vision systems, thermal cameras enhance driving safety by detecting the heat signatures of objects, such as pedestrians or animals, and providing visual alerts to the driver. This significantly reduces the risk of accidents in low-visibility conditions like darkness, fog, rain, or snow. Thermal cameras are also used in pedestrian detection systems, where they identify the heat emitted by people, helping prevent collisions by alerting the driver to their presence. This technology is particularly useful in urban environments or areas with heavy foot traffic.

The primary difference between thermal and infrared cameras lies in the type of infrared light they use. Thermal imaging systems utilize mid or long-wavelength infrared light, whereas infrared systems use short-wavelength infrared light. Thermal imagers are passive devices that detect variations in heat but cannot sense reflected light. Because they operate in a longer infrared wavelength spectrum than active infrared systems, they remain unaffected by incoming headlights, fog, haze, and dust. This capability allows thermal cameras to detect temperature changes, making them ideal for identifying heat signatures from objects or people in complete darkness. While both thermal and infrared cameras detect heat, thermal cameras are particularly advantageous for their ability to function under a wider range of conditions.

Germany to lead the automotive camera market in Europe.

Germany is expected to be the largest market for automotive cameras in the European region during the forecast period. The German automotive camera market is expected to grow due to the increasing safety awareness and government regulations mandating advanced systems in vehicles. Major German OEMs like Volkswagen and Daimler have already integrated advanced features to enhance the driving experience, offering most ADAS features as standard in their premium vehicles. Since July 2022, the country has mandated the use of ADAS features such as automotive emergency braking, driver monitoring, and lane departure warning systems. The presence of key manufacturers such as Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), and Continental AG (Germany) significantly contributes to this growth. Recent developments, such as camera heads enabling ADAS functionality (including 3-to-8-megapixel versions scalable up to 12 megapixels) released by Robert Bosch GmbH in September 2023, highlight the advancements and increasing demand in the market.

Key Players

The automotive camera market is dominated by global players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Valeo (France), ZF Friedrichshafen AG (Germany), and Denso Corporation (Japan), and Ficosa International SA (Spain), among others. These companies adopted new product development strategies, expansion, partnerships & collaborations, and mergers & acquisitions to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=125124333