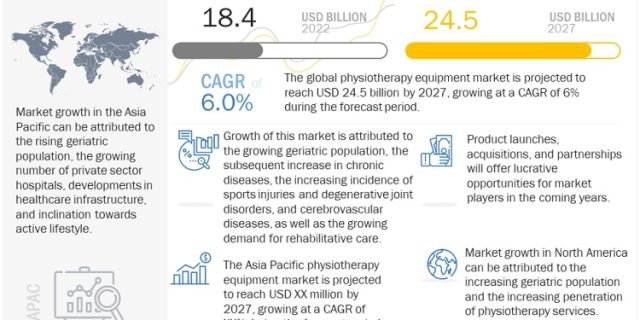

The global physiotherapy equipment market is projected to reach USD 24.5 billion by 2027 from USD 18.4 billion in 2022, at a CAGR of 6.0% during the forecast period. The growing demand for rehabilitative care, the growing incidence of sports injuries, degenerative joint disorders, and cerebrovascular disease, and rapidly growing geriatric population; the subsequent increase in the global prevalence of chronic diseases is driving the growth of market.

Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=65250228

In this report, the physiotherapy equipment market is segmented on the basis of product, application, end user, and region. Based on product, the physiotherapy equipment market is divided into two major segments, namely, equipment and accessories. The equipment segment accounted for the largest share of the physiotherapy equipment market in 2021. Market growth is largely driven by factors such as the rapidly aging population, the growing adoption of healthier lifestyle habits, as well as the increasing incidence of injuries and chronic diseases. The equipment segment is further segmented into electrotherapy equipment, ultrasound equipment, exercise therapy equipment, heat therapy equipment, cryotherapy equipment, combination therapy equipment, continuous passive motion therapy equipment, shockwave therapy equipment, laser therapy equipment, magnetic pressure therapy equipment, traction therapy, and other physiotherapy equipment (hydrotherapy and vacuum therapy). Electrotherapy equipment dominates the market with a share of about 25.6% in 2021, owing to their significant use in the treatment of musculoskeletal conditions with minimal/no side effects.

Based on the application, the physiotherapy equipment market is segmented into musculoskeletal applications, neurological applications, cardiovascular and pulmonary applications, pediatric applications, gynecological applications, and other applications (including sports and palliative care). In 2021, the musculoskeletal applications segment accounted for the largest share of physiotherapy equipment market, which can be attributed to the rising incidence of musculoskeletal disorders, growth in the geriatric population, and the increasing number of accidents.

Based on End User, the physiotherapy equipment market is segmented into physiotherapy & rehabilitation centers, hospitals, home care settings, physician offices, and other end users (community health centers and elderly care facilities). In 2021, physiotherapy & rehabilitation centers accounted for the largest share of the physiotherapy equipment market. This can primarily be attributed to the wide usage of physiotherapy equipment in these centers and the increased availability of specialized physiotherapists in such facilities.

In 2021, Europe accounted for the largest share of the global physiotherapy equipment market. The large share of this regional segment can be attributed to the rising geriatric population, increasing inclination for active lifestyles, the penetration of physiotherapy services, and favorable healthcare reforms. The Asia Pacific market is projected to register the highest CAGR during the forecast period. Market growth in the Asia Pacific is attributed to the growth in emerging markets such as China and India, that are expected to present significant growth opportunities for the major stakeholders in the physiotherapy market. Additionally, increasing healthcare awareness and growing number of healthcare facilities in Asian countries are also the key factors supporting the market growth.

Major Companies:

Colfax Corp. (US), BTL Industries (UK), Performance Health (US), ITO Co., Ltd. (Japan), Enraf-Nonius B.V. (Netherlands), Dynatronics Corporation (US), Mectronic Medicale (Italy), EMS Physio Ltd. (UK), Whitehall Manufacturing (US), Zimmer MedizinSysteme GmbH (Germany), Zynex Inc, (US), Richmar (US), Life Care Systems (India), Storz Medical AG (Germany), Mettler Electronics Corp (US), Algeos (UK), Gymna (Belgium), Astar (Poland), HMS Medical Systems (India), Embitron s.r.o (Czech Republic), Proxomed (Germany), Tecnobody (Italy), Johari Digitals (India), Power Medic (Denmark), and CoolSystems Inc. (US)

Recent Developments of Physiotherapy Equipment Industry

In February 2022, Colfax Corp (US), announced the renewal of the partnership with Professional Football Athletic Trainer Society (PFATS, US), that allowed the company to endorse and recommend its products to certified athletic trainers.

In January 2022, BTL Industries (UK) acquired Schepp MedTech (US). This acquisition was carried out for robots to enhance BTL’s already very complex physiotherapy product portfolio.

In January 2022, Zynex, Inc. (US) announced the launch of Post-operative and OA (Osteoarthritis) knee braces. The Knee braces can limit the wear and tear on the affected joint, enabling inflammation to settle and reduce pain/degeneration of the affected knee joint and thereby delaying or minimizing the need for surgery.

In January 2021, Dynatronic Corporation (US) launched a new bariatric stand-in table with a motorized patient lift and an H-brace treatment table.