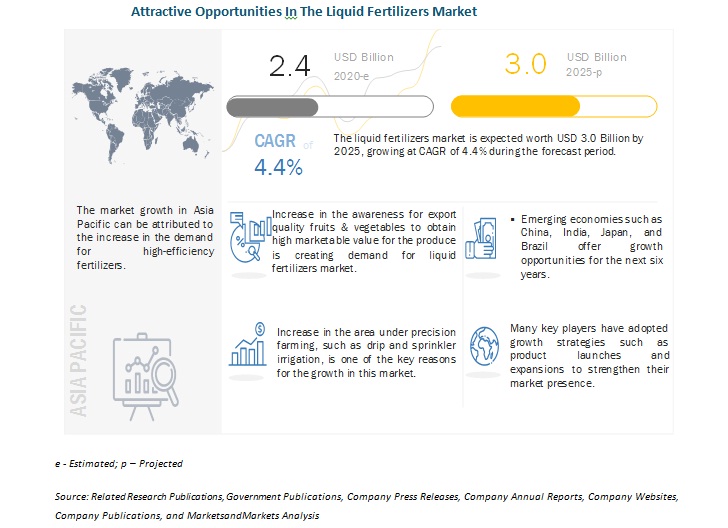

The global liquid fertilizers market size is estimated to be valued at USD 2.4 billion in 2020 and is projected to reach USD 3.0 billion by 2025, recording a CAGR of 4.4%. The increase in demand for enhanced high-efficiency fertilizers, ease of use and application of liquid fertilizers, and adoption of precision farming and protected agriculture are some of the factors that are projected to drive the growth of the market.

Liquid Fertilizers Market Dynamics

Driver: Growth in demand for enhanced high-efficiency fertilizers

Enhanced, efficient application of liquid fertilizers ensures that crops and plants receive nutrients in an amount that is required at the right time and at the right place, with minimum wastage. Enhanced efficiency fertilizers (EEF) are growing substantially in the agriculture industry in various fields such as cereals and industrial crops, as a result of the emergence of new urease inhibitors and inexpensive polymer coating technologies. Such application of enhanced efficiency fertilizers also helps in reducing the negative impact of nutrients by way of leaching into water reservoirs.

Restraint: High handling costs

One of the major restraints in the growth of the liquid fertilizers market is the high storage cost of liquid fertilizers, along with the high cost of installation. Liquid fertilizers are water-soluble. The cost of mixing the nutrients in the water is high, and so is the cost of transportation, as fertilizers in the liquid form require distinctive handling and storage facilities. This is hindering the growth of the market around the globe, especially in regions such as Africa and the Middle East due to the lack of awareness about the application of liquid fertilizers.

Opportunity: New emerging economies

The increasing population in world has resulted in increasing demand for food, which will lead to further increase in the consumption of fertilizers. However, the major concerns in are the pollution and contamination of soil as well as their harmful effects on humans and the environment.

To combat these harmful effects, governments are emphasizing on the use of fertilizers that are less harmful to the soil. Hence, there is an increase in the rate of awareness about liquid fertilizers among farmers, especially in China and India. Manufacturers, along with NGOs, educate farmers about their potential short-term and long-term benefits.

Challenge: Unfavorable regulatory standards

The fertilizer industry, like other industries, has its own share of regulatory and other state-level interventions, which propel and arrest its momentum. Policies unfavorable for the industry, including restrictions in terms of sourcing, production, and distribution norms; the end of subsidy support; the stipulation of the maximum retail price; and regulations concerning the quantum and direction of end use have a considerable impact on the overall industry.

Key players:

Key players in this market include Nutrien, Ltd. (Canada), Yara International ASA (Norway), Israel Chemical Ltd. (Israel), K+S Aktiengesellschaft (Germany), Sociedad Química y Minera de Chile (SQM) (Chile), The Mosaic Company (US), and EuroChem Group (Switzerland).

These major players in this market are focusing on increasing their presence through expansions & investments, mergers & acquisitions, partnerships, joint ventures, and agreements. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities, along with strong distribution networks across these regions.