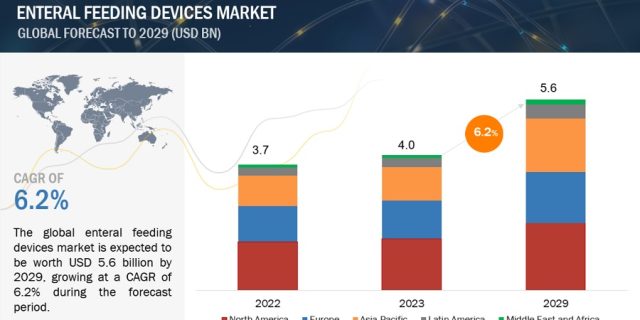

The global enteral feeding devices market is witnessing rapid growth driven by the increasing prevalence of chronic diseases, especially among the aging population. Valued at $4.0 billion in 2023, this market is projected to reach $5.6 billion by 2029, expanding at a robust compound annual growth rate (CAGR) of 6.2%.

Enteral feeding devices offer a reliable solution for delivering essential nutrients to patients who cannot consume sufficient food orally due to conditions such as swallowing difficulties, appetite loss, or medical treatments like surgery, radiation therapy, or chemotherapy. These devices are transforming the healthcare industry, providing significant advantages for manufacturers and patients alike.

Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=183623035

The Rising Demand for Enteral Feeding

The global rise in chronic diseases, coupled with the growing elderly population, is a major driving force behind the increasing demand for enteral feeding devices. As people age, they become more susceptible to illnesses such as cancer, neurological disorders, and digestive issues, which can impair their ability to swallow or maintain adequate nutrition.

Furthermore, heightened awareness among healthcare professionals and the public about the benefits of enteral feeding is contributing to its wider adoption. Educational initiatives and advancements in enteral feeding technology are playing a pivotal role in fostering this growing awareness.

Market Dynamics and Opportunities

While the rapid growth in the geriatric population and age-related chronic diseases serve as a key driver for the enteral feeding devices market, the lack of patient awareness remains a significant restraint. However, the growing demand for enteral feeding in the home care sector presents an attractive opportunity for market growth. Improvements in device portability, user-friendliness, and remote monitoring capabilities are facilitating the transition to home-based care, offering greater convenience and cost-effectiveness for patients and healthcare systems.

Conversely, the dearth of skilled professionals and endoscopy specialists poses a challenge to the market’s growth. The growing demand for enteral feeding might outpace the availability of trained healthcare professionals and specialists required for proper device placement, management, and monitoring.

Market Segmentation and Regional Outlook

The enteral feeding devices market is segmented by product type, age group, application, end-user, and region. By type, the enterostomy feeding tubes segment is expected to exhibit the highest CAGR from 2024 to 2029, driven by their suitability for long-term enteral feeding and direct placement into the stomach or small intestine.

In terms of application, the head and neck cancer segment within the oncology sector is anticipated to experience the highest CAGR during the same period. Head and neck cancer treatments often cause swallowing difficulties and mouth sores, necessitating the use of enteral feeding tubes to deliver essential nutrients.

Geographically, North America is projected to account for the largest CAGR in the enteral feeding devices market during the forecast period. This growth is fueled by factors such as government initiatives promoting diagnostic health awareness, subsidies for various treatments, and the region’s evolving healthcare landscape.

Key Players and Market Ecosystem

The enteral feeding devices market is becoming increasingly competitive, with new players entering the market and established companies vying for market share. Major players in the industry include Fresenius SE & Co. KGaA, Cardinal Health, Inc., Nestlé S.A., Avanos Medical, Inc., Danone S.A., Becton, Dickinson and Company, B. Braun Melsungen AG, CONMED Corporation, Cook Medical, Moog Inc., Boston Scientific Corporation, Baxter International Inc., Vygon, and others.

The market ecosystem is characterized by consolidation, particularly in the homecare settings, creating larger entities with greater purchasing power. This can lead to lower prices for supplies and equipment, putting pressure on smaller players to maintain profitability while keeping prices competitive.

As the enteral feeding devices market continues to evolve, it presents opportunities for innovation, strategic partnerships, and improved patient care, ultimately contributing to the overall growth and development of the healthcare industry.