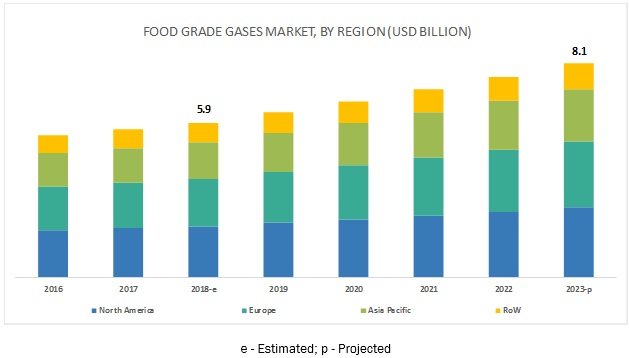

The global food-grade gases market is estimated to be valued at USD 5.9 billion in 2018 and is projected to reach USD 8.1 billion by 2023, at a CAGR of 6.7% from 2018 to 2023. The demand for food-grade gases is significantly increasing due to factors such as growing consumer preferences toward convenient food packaging, owing to their on-the-go lifestyles, and the growing number of microbreweries across all regions. The high cost associated with power and stringent government regulations to meet quality standards inhibits the growth of the food-grade gases market. The North American market is projected to hold the largest market share, owing to the large food & beverage industry in the region and the presence of all big players. Also, the rising trend of microbreweries has driven the North American food-grade gases market.

Report Objectives:

- Determining and projecting the size of the food-grade gases market, with respect to type, end-use, mode of supply, application, and region, over a five-year period ranging from 2018 to 2023

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors on the basis of the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions

- Identifying and profiling key market players in the food-grade gases market

- Determining the market share of key players operating in the food-grade gases market

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across regions.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=9473111

By application, the freezing & chilling segment is projected to account for the largest share in the food-grade gases market

The food industry’s key challenges are to avoid microbial deterioration and increase the shelf life of products. One of the most effective methods of fighting these microbes is by chilling & freezing the products. When the temperature is lowered below the freezing point, the growth of micro-organisms decreases rapidly. Freezing slows down many enzymatic processes as well, thereby making food products more shelf stable. Chilling a food product reduces the risk of bacterial growth. The freezing and chilling of foods are essential to prevent spoilage. As manufacturers, consumers, and retailers demand these technologies, the use of food-grade gases is expected to increase.

The dominance of the carbon dioxide segment in the food-grade gases market is attributed to the growing number of microbreweries across the world

Carbon dioxide is used for refrigeration and cooling in solid (dry ice) and liquid forms. This is because it sublimates to gas at a very low temperature of -78.5 °C (-109.3 °F). It is widely used for carbonation in soft drinks, beers, and other alcoholic drinks. The gas has applications in conserving wine, grape juices, and other juices. Beverage-grade carbon dioxide, which is considered an ingredient in the beverage industry, should be compliant with the strongest regulations of the EC (E290) and International Society of Beverages Technologists (ISBT). Carbon dioxide is also used for Modified Atmosphere Packaging (MAP); it is injected and frequently removed to eliminate oxygen from the package. Due to the advancement in packaging technologies, the demand for carbon dioxide is projected to remain the highest in the food-grade gases market.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=9473111

North America is projected to retain the largest market share during the forecast period due to the growing demand for packaged food in the region

North America accounts for a 33% share of the food-grade gases market. The large beverage industry and the rising trends of microbreweries create a huge demand for carbon dioxide in the North American region, with the US being the largest and fastest growing market. Also, because of the presence of highly organized retail chains and cold chain infrastructure, the North American region holds the largest market share in the food-grade gases market. Further, the increasing preferences for on-the-go meals than conventional home-cooked meals and the growing demand for bakery and confectionery have led to a significant increase in the demand for food-grade gases in North America.

The key players profiled in the food-grade gases market include The Linde Group (Germany), Air Products & Chemicals, Inc. (US), Air Liquide (France), Wesfarmers Limited (Australia), The Messer Group GmBH (Germany), SOL Group (Italy), Taiyo Nippon Sanso (Japan), Gulf Cryo (Kuwait), Massy Group (Carribean), PT Aneka Gas Industri (Indonesia), The Tyczka Group (Germany), and Air Water, Inc. (Japan).

Key questions addressed by the report:

- What are the growth opportunities for the food-grade gases market?

- What are the major technologies used in the food-grade gases?

- What are the key factors affecting the market dynamics?

- What are some of the major challenges and restraints that the industry faces?