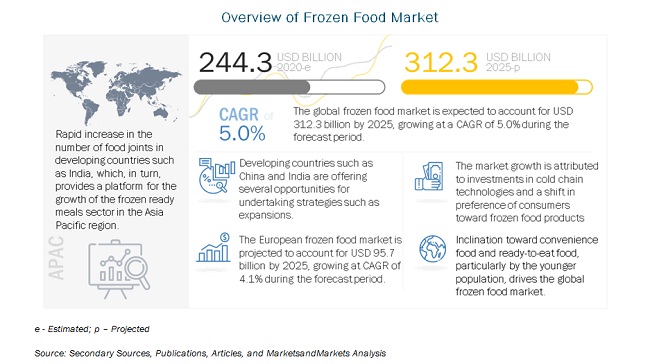

The report “Frozen Food Market by Product (Fruits & Vegetables, Dairy, Meat & Seafood), Type (Raw Material, Half Cooked), Consumption, Distribution Channel, And Region (North America, Europe, Asia Pacific, South America, And Mea) – Global Forecast To 2025″, The frozen food market is estimated to account for about USD 244.3 billion in 2020 and is projected to reach a value of nearly USD 312.3 billion by 2025, growing at a CAGR of 5.0% from 2020.

The retail food industry has witnessed significant growth over the past few years, globally. The development of retail channels in the form of supermarkets, hypermarkets, and convenience stores has driven the growth of the frozen food market. These large food chains form an important growing outlet for frozen food products, owing to the latest trend of on-the-go consumption. The rising per capita income and increasing number of working women, globally, have further accelerated the market growth.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=130

Drivers: Rising demand for convenience food

The increasing consumer preference toward convenience foods indirectly favors the increasing demand for frozen products as they require less time and effort as compared to cooking from scratch. The processed food market is driven by the greater need for convenience due to the busy lifestyles of consumers. This, in turn, increases the demand for frozen products. Increasing disposable income is also one such factor that has a huge influence on the growth of the frozen food market as it increases the buying power of consumers.

Challenges: Lack of cold chain infrastructure in developing economies

Cold chain logistics have proved to be a vital requirement to increase the market share of frozen food in any country. However, developing countries are still lacking in cold chain infrastructure and are unable to supply safe frozen food products to their citizens. Frozen food has a long shelf-life; however, due to lack of infrastructure, the product is wasted easily leading to a loss for frozen food manufacturers. Lack of investment due to the monetary crisis in developing economies has been one reason slowing down the cold chain logistics business. This, in turn, has hampered the frozen food market. Poor infrastructure in cold chain logistics has also directly impacted the import & export business of frozen food products in developing countries such as Bangladesh, South Africa, and Myanmar. However, these developing countries offer a huge opportunity for investment in the frozen food market due to the rising acceptance among consumers in urban areas.

The offline segment is estimated to account for the largest share in the frozen food market in 2020.

By distribution channel, the offline segment is estimated to account for the largest share in the frozen food market in 2020. The infrastructure of the convenience stores and hypermarkets includes freezing and temperature-controlled facilities, which are driving the growth of this segment as a distribution channel for frozen products.

Make an Inquiry:

https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=130

Europe is estimated to dominate the frozen food market in 2020.

Europe is estimated to account for the largest market share in the frozen food market in 2020. The region is projected to offer huge growth potential to the frozen food market. The market in Germany is estimated to be the major contributor to the growth in the region. The European market is driven by the robust growth of the food industry, which has supported the ready-to-eat snack food industry to gain acceleration in this market.

This report includes a study of marketing and development strategies, along with the product portfolios of the leading companies in the frozen food market. It includes the profiles of the leading companies such as General Mills Inc (US), Conagra Brands, Inc. (US), Grupo Bimbo S.A.B. de C.V. (Mexico), Nestle SA (Switzerland), Unilever (Netherlands), Kellogg Company (US), McCain Foods Limited (Canada), Kraft Heinz Company (US), Associated British Foods plc (UK), Ajinomoto (Japan), Vandemoortele NV (Belgium), Lantmannen Unibake International (Denmark).