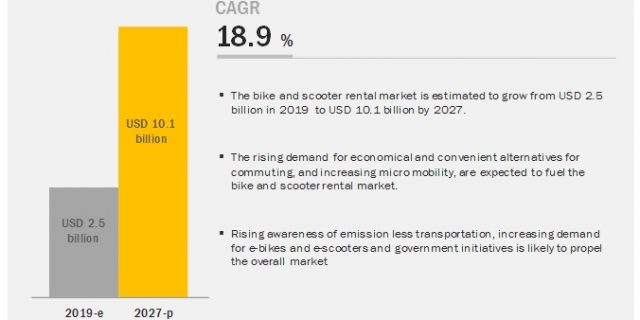

The report “Bike and Scooter Rental Market by Service (Pay as you go and Subscription-based), Propulsion (Pedal, Electric, and Gasoline), Operational Model (Dockless and Station-based), Vehicle (Bike, Scooter), and Region – Global Forecast to 2027″ The global bike and scooter rental market is projected to grow from USD 2.5 billion in 2019 to reach USD 10.1 billion by 2027, at a CAGR of 18.9%. The growth of the bike and scooter rental market is influenced by the rising demand for micro mobility and shift of consumer preference toward a more economical, convenient, and flexible mode of transport.

Electric propulsion is expected to be the largest segment of the bike and scooter rental market, by propulsion type

The increasing efforts to control pollution levels in developing countries have driven the demand for electric-powered vehicles. The decreasing price of batteries and the reliability of electric drivelines have encouraged more people to adopt electric two-wheelers. Countries like China and Norway have invested plenty of resources in providing a wide network of battery charging stations. Government subsidies have also played a major role in the adoption of EVs. In case of electric micro mobility sharing services, companies like Cityscoot, Muving, Bird, Yulu, Skip, and COUP are offering 100% green initiatives toward small distance commuting, thereby making the electric segment dominate the bike and scooter rental market vy 2027.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=122654882

Scooter is expected to be the fastest segment, by vehicle type

The scooter segment is expected to be the fastest market during the forecasted period. Scooters as micro mobility vehicle have evolved after bikes, and now e-scooters have taken over other sharing rentals. The advantages like light weight and compact design, have made scooters replace other modes of public transit, especially for small distance trips. According to the National Association of City Transportation Officials, e-scooters have over taken bike sharing as it was reported in 2018 that out of 84 million micro mobility trips, 45.8% were of scooters. Most companies like Lime, Bird, VOI Technology, Spin, Skip, nextbike, eCooltra, Mobike, ofo, Yulu, Vogo, and JUMP are operating through bikes and scooters. Investments, acquisitions, and joint ventures made by these companies indicate the alarming concerns over safeguarding non-renewable resources.

Asia Pacific is expected to be the fastest growing market during the forecast period

The Asia Pacific market is the largest because of the growth in India, China, Japan, and South Korea. Governments from different countries in the region have taken various initiatives to promote renewable sources of energy to reduce carbon emissions. Electric vehicles are perfectly suited for micro mobility as they are eco-friendly, easy to maintain, and have a lower cost of operation. The major reason for the growth of bike and scooter rental market in China and India is the growing concerns over pollution and increasing traffic congestion due to the number of vehicles. China has embraced bike and scooter rental services as a necessary measure to reduce carbon emissions and traffic congestion. The increased use of application-based services and internet penetration has led to ride sharing.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=122654882

Key Market Players:

The global Bike and Scooter Rental Market is dominated by major players such as Lime (US), Jump (US), Bird (US), ofo (China), Grow Mobility (China), nextbike (Germany), Cityscoot (France), and COUP (Germany), among others.

Critical Questions:

- Where will rental and sharing services take the industry in the long term? What will be the growth of the market?

- How e-scooters and e-bikes will transform the outlook of the overall automotive industry?

- What are the upcoming trends in the market? What impact would they make post 2022?

- What are the key strategies adopted by the top players to increase their revenues?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst