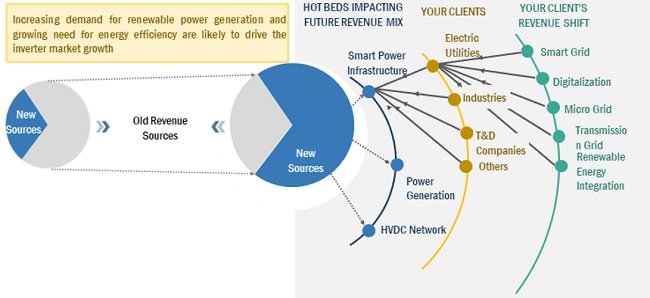

New Revenue Pockets:

The increasing investments in the renewable energy sector and the rise in the number of solar installations attributed to government led incentives and schemes worldwide fueling demand for inverters to drive the demand for global inverters.

The global inverter market is expected to grow at a CAGR of 15.7% to USD 33.8 billion by 2027, up from an estimated USD 16.3 billion in 2022.

With the increasing demand for solar power, various technological developments are taking place in the inverter market. Remote and wireless diagnostics, smart grid-tied inverters, and predictive maintenance are important technological innovations that can revolutionize the inverter market. Many companies are coming up with inverters equipped with these technologies. Also, research is underway to enhance the technologies further to make inverters more advanced and efficient.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263171818

Key Market Players:

The inverter market is dominated by a few major players that have a wide regional presence. The major players in the inverter market are Huawei Technologies (China), Sungrow Power Supply (China), SMA Solar Technology (Germany), Power Electronics (Spain), FIMER (Italy), SolarEdge Technologies (Israel), Fronius International (Austria), Altenergy Power System (US), Enphase Energy (US), Darfon Electronics Corporation (China), Schneider Electric (France). Between 2018 and 2022, the companies adopted growth strategies such as sales contracts to capture a larger share of the inverter market.

The solar inverter segment is expected to be the second fastest growing segment during the forecast period. Solar inverters transform the variable DC output of PV solar panels into usable AC. This AC power can then be used by end users from the residential and commercial sector and PV plants to operate electric appliances/machines. For some applications, such as LED night lights and cell phone charging, end users can directly use the DC power from the solar panel. Rising installations of roof-top top solar PV systems with favourable government policies is expected to fuel the demand for solar inverters during the forecast period.

The inverter market, by output voltage, has been segmented into 100–300 V, 300–500 V, and Above 500 V. Above 500 V, by output voltage, is expected to be the second fastest-growing market during the forecast period. The global countries pledge toward climate change, which increased the investments in the power infrastructure in various regions. Also, Technological advancements such as The transformer-less string inverters with voltage rating above 500 V have been developed for PV plants. The string inverters based on this technology offer high flexibility in terms of PV array configurations and maximize power yields. The rising investments in development of off grid and on grid pv plants is expected to drive the above 500 V segment in the inverter market.

Ask Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=263171818

Increasing investments in development of smart grids will provide several opportunities in the inverter market. With the increasing demand for ensuring the grid’s reliability under high solar penetration, the grid-support inverter should ideally have capabilities such as reactive power control and voltage ride through to help stabilize system voltage and smooth the system output. This enables users of energy and the microgrids serving them to control energy usage better. Compared to standalone systems, grid-connected systems require inverters to synchronize with the utility grid, which means operating under the same voltage. The output AC power should be in phase with utility power. According to the Smart Electric Power Association and the Electric Power Research Institute, smart inverters may be one of the most cost-effective mechanisms for addressing many grids management challenges and, in some cases, could help defer or avoid certain distribution, transmission, and electric supply upgrades. Hence, an increase in smart grid investments is expected to create growth opportunities for the market players.