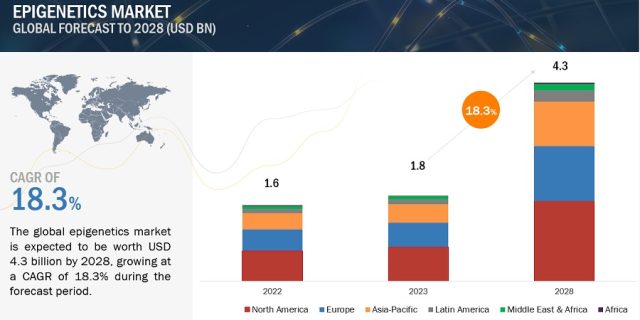

The epigenetics market is projected to reach USD 4.3 Billion by 2028 from USD 1.8 Billion in 2023, at a CAGR of 18.3% during the forecast period. Market growth is largely driven growing investment in research & development and rising demand for epigenetic-based therapeutics.

Epigenetics Market by Product & Service (Enzymes (DNA-modifying Enzymes), Kits & Reagents (Antibodies), Instrument, Software), Method (DNA Methylation), Technique (NGS, PCR, Mass Spectrometry), Application (Oncology, Immunology) – Global Forecast to 2028

Download a PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=896

Based on product & service, the global epigenetics market is segmented into kits & reagents, enzymes, instruments and accessories, software, and service. The kits & reagents segment is further segmented into antibodies ChiP-sequencing kits, whole genome amplification kits, bisulfite conversion kits, 5-HMC and 5-MC analysis kits, histones, and other kits & reagents. The kits & reagents segment accounted for the largest share of the market in 2022. The highest share of the segment is owing broadening applications of chromatin immunoprecipitation (ChIP) in research studies associated with epigenetic regulatory systems and growing demand for DNA modification enzymes and histone modification enzymes.

Based on method, the epigenetics market is segmented into DNA methylation, histone modifications, and other methods. In 2022, the DNA methylation segment accounted for the largest share of the epigenetics market. The largest share can be attributed to expanding use of DNA methylation approaches across non-oncology applications. Additionally increase in R&D to explore the role of histone modifications in oncology applications contributes to the highest CAGR recorded by the histone modifications segment in the epigenetics market.

Based on technique, the epigenetics market is divided into NGS, PCR & qPCR, mass, spectrometry, sonication, and other techniques. The NGS segment accounted for the largest share of the market in 2022. Rising demand for NGS solutions across epigenetic and mutational research studies is serving as the driving factor for growth of NGS segment.

Based on application, the epigenetics market is segmented oncology, metabolic diseases, immunology, developmental biology, cardiovascular diseases, and other applications. In 2022 oncology segment accounted for the larger share of the market. The higher share of this segment is due to the growing demand for epigenetic processes such as DNA methylation and histone modification in the development of novel cancer therapeutic candidates.

Based on end user, the global epigenetics market is segmented into academic & research institutes, pharmaceutical & biotechnology companies and hospitals & clinics. In 2022, academic & research institutes segment accounted for the largest share of the market. The key factor of driving the growth of the this market segment can be attributed to the adoption of epigenetics products across different research sectors including university laboratories and government research institutions.

Based on the region, the epigenetics market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East and Africa. In 2022, North America accounted for the largest share of the epigenetics market, Europe is the second largest region in 2022. The growth factors can be attributed to to the robust network of epigenetic product manufacturers, and increasing NGS-based research.

The Asia Pacific market is expected to register the highest CAGR of 19.1% during the forecast period. In 2022, the growth of the market is driven by the growing pharmaceutical industry, implementation of favorable government policies and the low cost of epigenetic consumables in this region.

The epigenetics market is moderately consolidated, with a small number of players competing for market shares. Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Illumina, Inc. (US), PacBio (US), Abcam plc (UK), Active Motif, Inc. (US), Bio-Rad Laboratories Inc. (US), Promega Corporation (US), Revvity (US), Qiagen (Germany), New England Biolabs (US), Zymo Research Corporation (US), Diagenode SA (US), F. Hoffmann-La Roche Ltd (Switzerland) and Epigentek Group Inc. (US) are some of the leading players in this market. Most companies in the market focus on organic and inorganic growth strategies, such as product launches, expansions, acquisitions, partnerships, and agreements, to increase their product offerings, cater to the unmet needs of customers, increase their profitability, and expand their presence in the global market.

Recent Developments of Epigenetics Industry:

- In August 2023, PacBio (US) acquired Apton Biosystems (US) to accelerate the development of a next-generation, high-throughput, short-read sequencer.

- In March 2022, Thermofisher Scientific Inc (US) launched the CE IVD Marked Next Generation Sequencing Instrument designed to be used in in clinical laboratories to perform both diagnostic testing and clinical research on a single instrument

- In January 2022, Illumina, Inc. (US) entered into an agreement with SomaLogic (US) to introduce SomaScan Proteomics Assay in high throughput next-generation sequencing (NGS) platforms manufactured by Illumina

![Pen Needles Market Size, Share, Trends and Revenue Forecast [2028]](https://mnmblog.org/wp-content/uploads/2024/07/pen-needles-market-350x196.jpg)