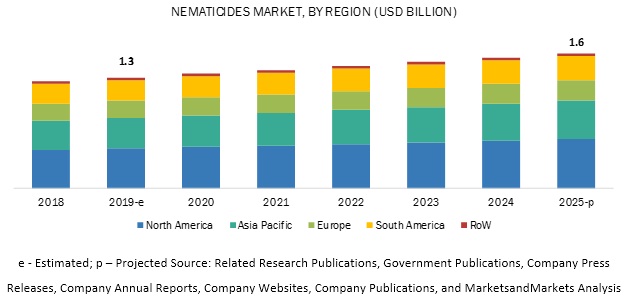

The report “Nematicides Market by Type (Fumigants, Carbamates, Organophosphates, Bionematicides), Mode of Application (Fumigation, Drenching, Soil Dressing, Seed Treatment), Nematode Type (Root Knot, Cyst), Crop Type, Form, and Region – Global Forecast to 2025″ The global nematicides market size is estimated to be valued at USD 1.3 billion in 2019 and is expected to reach a value of USD 1.6 billion by 2025, growing at a CAGR of 3.4% during the forecast period. Factors such as the growing demand for biological products and increasing number of product launches catering to the requirement of crop-specific nematodes drive the growth of the market.

Fumigation and carbamates, by mode of application and type, are estimated to hold the largest shares in the nematicides industry, in terms of value, in 2019

Fumigation is a mode that is both cost-effective and efficient for tackling the problem of nematodes. In regions where there is a scarcity of water, such as South Africa, and mechanically advanced economies such as the US and Canada where the adoption of drip irrigation is feasible, the market for fumigation is set to grow. There has been an increase in the adoption of non-toxic products in soils due to the growing interest in sustainable agriculture. This has aided the growth in the use of carbamates, which are relatively less toxic than fumigants.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=193252005

Vegetables, by crop type, estimated to account for the largest market share, by value, in 2019

Vegetables accounted for the largest share in the nematicides market due to the increasing acreage utilized for the cultivation of vegetables. The increased international demand for fruits & vegetables is also driving the growth of the market. The major players in the market such as BASF SE (Germany), Adama Agricultural Solutions Ltd (Israel), and Syngenta (Switzerland) are introducing nematicide solutions for crops such as tomatoes, potatoes, and peas. The increasing incidences of potato-cyst nematodes and root-knot nematodes in tomatoes have also been driving the adoption of nematicides for vegetables.

North America to be the largest market for nematicides during the forecast period.

The region is a host to some of the major players in the nematicides market such as BASF SE (Germany), Bayer AG (Germany), Syngenta (Switzerland), and Nufarm Ltd (Australia) who actively invest on new product launches that would cater to nematode attacks on field crops such as soybean, corn, and cotton which are majorly produced in countries such as the US and Mexico. The acreage which is being brought under field crops is growing due to increased international and domestic demand for these field crops. The adoption of genetically modified seeds has also increased the cases of nematode infestation on crops such as soybean and corn, thereby driving growth in the market.

Some of the major players operating in the nematicides market include Bayer AG (Germany), Syngenta Crop Protection AG (Switzerland), Corteva Agriscience (US), BASF SE (Germany), Adama Agricultural Solutions Ltd (Israel), FMC Corporation (US), Nufarm (Australia), UPL Limited (India), Isagro Group (Italy), Valent USA (US), Chr. Hansen (Denmark), Certis USA LLC (US), Marrone Bio Innovations (US), American Vanguard Corporation (US), Crop IQ Technology (UK), Real IPM Kenya (Kenya), Horizon Group (India), Agri Life (India), Crop IQ Technology Ltd (UK), and T. Stanes & Company Limited (India).

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=193252005

Key questions addressed by the report:

- Who are some of the key players operating in the nematicides market, and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and acquisitions in the nematicides market projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders, due to the benefits offered by the nematicides market, such as increasing revenue, environmental regulatory compliance, and sustainable profits for suppliers?

- Which regions are expected to show an increase in nematicide consumption based on data for regional infestation?