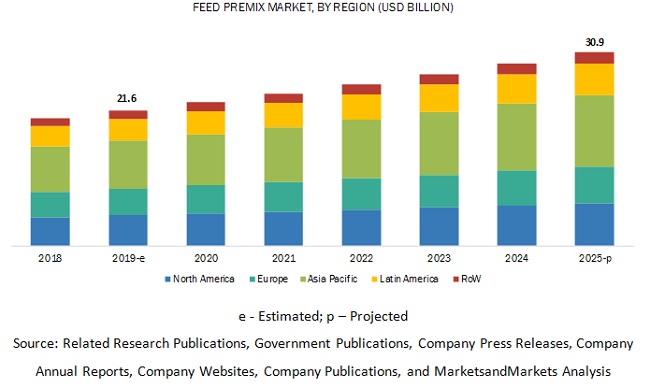

The global feed premix market size is estimated to account for a value of USD 21.6 billion in 2019 and is projected to grow at a CAGR of 6.2% from 2019, to reach a value of USD 30.9 billion by 2025. The rise in feed demand due to the increased in the consumption of livestock-based products is steering the growth of the market.

Report Objectives:

- To define, segment, and project the global market size for feed premixes

- To understand the structure of the feed premixes market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, concerning individual growth trends, prospects, and their contribution to the total feed premix market

- To project the size of the market and its submarkets, in terms of value and volume, for the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=170749996

The poultry segment is estimated to hold the largest market in the feed premix industry, in terms of value, in 2019

The poultry segment holds a larger market share in the feed premix market. According to FAO data, global meat production is projected to be 16% higher by 2025. An increase in demand for poultry meat is the primary driver for the growth of the overall meat production, owing to its high demand, low production cost, and lower product prices, both in developed and developing countries. According to FAO statistics, it has been stated that the production of poultry meat reached 120.5 million tonnes in 2017. This increase in demand for poultry meat is driving the need for feed premixes to be incorporated in compound feed.

The increasing demand for feed premix in the Asia Pacific and Latin American regions is driving the growth of the feed premix market.

Asia Pacific and Latin America are witnessing an increasing demand for feed premix for use mainly in the poultry feed industries. The population of developing countries in the Asia Pacific region—such as India, China, Indonesia, Vietnam, and Thailand—are expected to consume meat at an annual rate of 2.4% till 2030, according to the FAO report on “World Agriculture: Towards 2015/2030.” This has increased the demand for high-quality feed concentrates and premixes to enhance the meat weight and quality of the animals. Key players in the premix market have sensed this opportunity to start premix production plants in these regions, to meet the growing demand for feed premixes. Similarly, in South America, Brazil housed the largest cattle population in 2017, with a headcount of 330 million, and is projected to grow at a rate well above the regional average, according to the FAO. It is expected that the rising consumer awareness for nutritious products and the requirement for export quality meat products can establish a strong demand for feed premixes.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=170749996

Key Market Players:

Some of the major players operating in the feed premix market include Nutreco N.V. (The Netherlands), Koninklijke DSM (The Netherlands), Cargill (US), ADM (US), and DLG Group (Denmark), Charoen Pokphand Foods PCL (Thailand), Land O’Lakes, Inc. (US), AB Agri Ltd. (UK), Phibro Animal Health Corporation (US), BEC Feed Solutions Pty Ltd. (Australia), Kauno Grûdai (KG Group) (Lithuania), Devenish Nutrition, LLC. (UK), Lexington Enterprises Pte. Ltd. (Singapore), De Heus Animal Nutrition BV (The Netherlands), MEGAMIX LLC (Russia), Agrofeed Ltd. (Hungary), Cladan S.A. (Argentina), Kaesler Nutrition GmbH (Germany), Avitech Nutrition Pvt. Ltd. (India), and Advanced Animal Nutrition Pty Ltd. (Australia).